IESE Insight

Search funds asset class maintains global growth

- IESE’s 2024 international search fund report, covering those outside the United States and Canada, examined 320 funds formed in 40 countries on five continents.

- International search-fund activity reached new heights last year, with a record-setting 59 new funds formed and 31 acquisitions made.

- For the searchers, 71% of whom graduated from an MBA program, the most popular industry for acquisitions was technology, followed by services and healthcare.

What are the latest trends in international search fund activity? A record number of new searchers, strong acquisition success rate and growing geographic diversity of search fund principals, according to the latest studies out this year.

Working in collaboration with the Stanford Graduate School of Business, IESE Business School has released its 2024 biennial report on international search funds (register for free to download), covering funds outside the United States and Canada. The seventh edition of IESE’s report shows that the search-fund model continues to mature in Europe and Latin America while making inroads in Africa and Asia-Pacific. The 2024 report by Stanford GBS, meanwhile, finds that activity in the search fund community in the U.S. and Canada proceeds to grow, with a record number of searchers, additional investors and new classes offered at business schools.

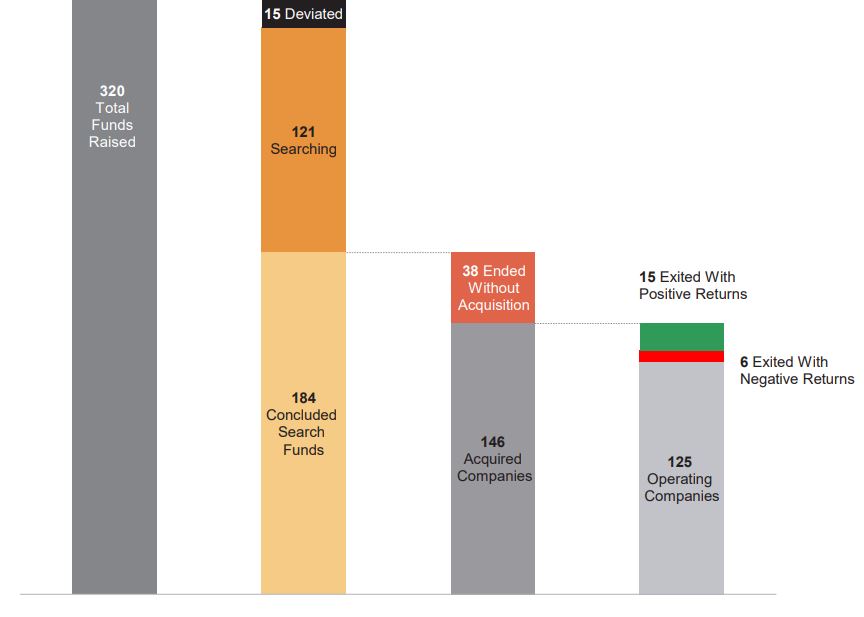

IESE’s study observes 320 international search funds in four stages of their life cycles: (1) raising a search fund (i.e., a pool of capital from aligned investors) that is dedicated to finding a company to acquire; (2) searching and acquiring; (3) operating the acquired company in search of greater success and growth (usually the longest and most compelling stage for searchers); and (4) exiting.

International search fund activity in 4 lifecycle stages

Source: Prepared by the authors based on IESE search fund surveys. Data as of December 31, 2023.

Gaining steam

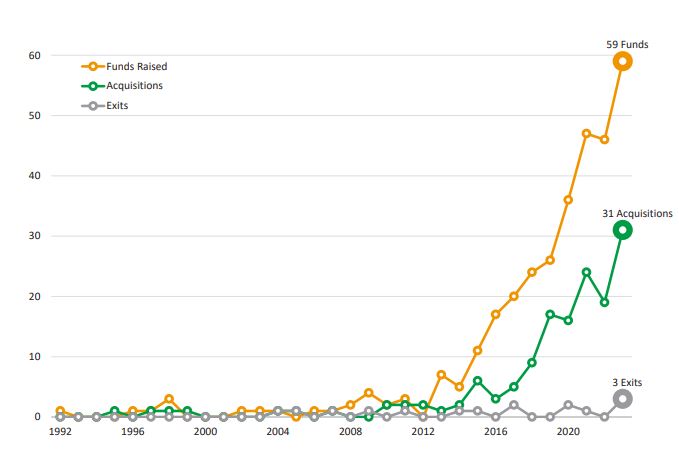

Similar to trends in the U.S. market, international search funds have continued to gain momentum and reach new peaks. In 2023, a record 59 new international search funds were formed. These included the debut of the model in six countries: China, Ireland, the Netherlands, New Zealand, South Africa and Vietnam.

Another new benchmark in the past year was the 31 acquisitions of companies by searchers, an indication of the model’s growing maturity outside the U.S., where it remains better known. Meanwhile, there were three new exits.

International search fund activity by year

Source: Prepared by the authors based on IESE search fund surveys. Data as of December 31, 2023.

Who are the searchers?

In this seventh edition of IESE’s international report, searchers ranged in age between 24 and 57. A large majority (71%) were MBA graduates, and over two-thirds raised their search fund within two years of their graduation. Forty-two percent of searchers obtained their MBA at U.S. business schools, a share that has fallen significantly over the years, and from around 50% in the report’s sixth edition, demonstrating growing awareness of the model worldwide.

Part of the appeal of the search fund model is that searchers hail from a broad array of professional backgrounds. In 2022 and 2023, 26% of new search fund principals had experience in management consulting, followed by financial services (20%) and line or general management (14%).

Partnerships remain significantly more popular internationally (40% of all funds in the study) than in the U.S. and Canada (19%). The median number of investors per fund was 16.

Early results

There have only been 21 exits outside of the U.S. and Canada so far: 15 with positive returns and six instances of companies failing. The handful of exits is owed at least in part to the relatively recent emergence of the search fund model internationally and the five- to 10-year period commonly found between acquisition and exit.

With 62% of acquisitions having happened since 2020, it is too early to draw firm conclusions about the financial performance of international search funds. However, for international funds, the latest returns on investment (ROI) are 2.0x and the internal rate of return (IRR) comes to 18.1%. Returns are calculated from the perspective of a fund’s initial investors who participated in both the search and acquisition phases of the fund and based on the CEO’s estimated equity valuations for operating businesses.

The median international search fund acquisition had a purchase price of $11.7 million, $7.8 million in revenues, EBITDA margin of 24% and 50 employees. In comparison, the median U.S. and Canadian acquisition profiled in Stanford GSB’s 2024 Search Fund Study had a purchase price of $12.8 million, revenues at purchase of $7.3 million, EBITDA margin of 22.5% and 40 employees.

Worldwide awareness

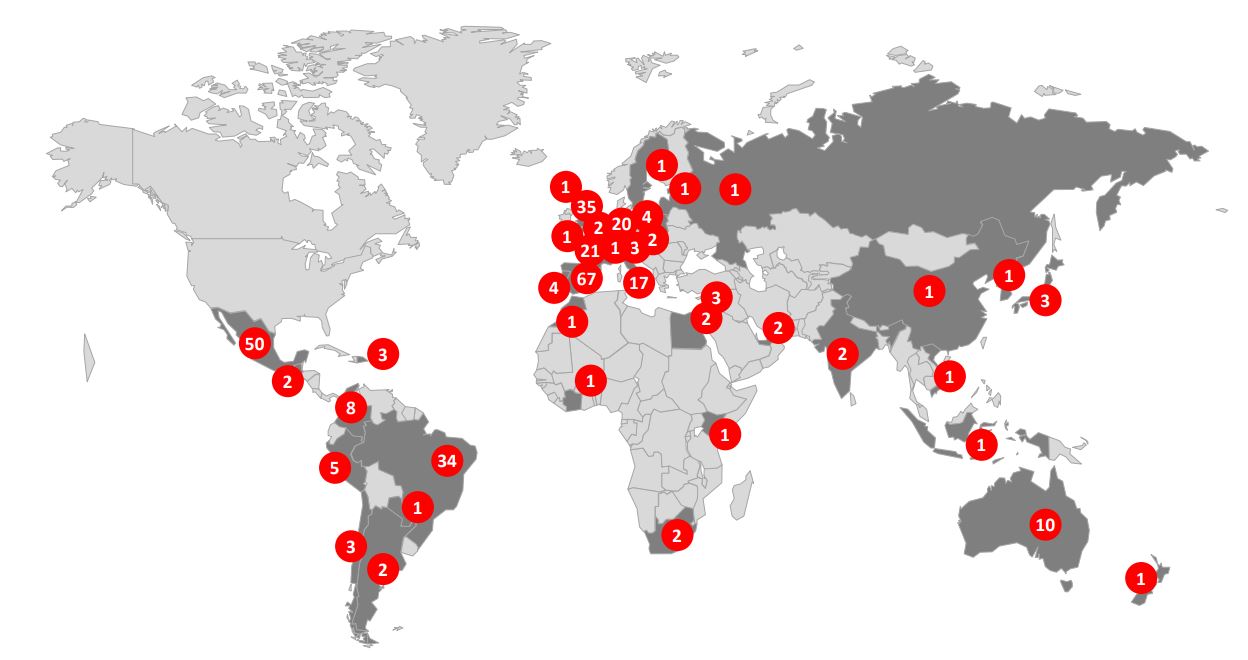

What are the hot spots for international searches now? Five continents have search funds of their own. Over the past decade, the international model has been launched most often in Spain (with 67 first-time funds launched over the years tracked), Mexico (with 50), the United Kingdom (with 35) and Brazil (with 34).

International search funds by country

Source: Prepared by the authors based on IESE search fund surveys. Data as of December 31, 2023.

Target profiles

In alignment with core search fund model principles, top targets for the model, according to the report, are companies with high-quality (i.e., recurring) revenue; strong earnings before interest, taxes, depreciation and amortization (EBITDA); and healthy industry growth.

Technology, manufacturing, healthcare, and transportation and logistics are the four most targeted areas for searchers. Within the technology class, software development was by far the most dominant subsection (9 acquisitions), followed by consumer electronics and hardware (2 acquisitions) and marketing technology (2 acquisitions).

Methodology in brief

This biennial study, undertaken in close partnership with the Stanford Graduate School of Business, targets all known first-time search funds outside the United States and Canada. It uses survey-based research methods to explore the financial returns and other important characteristics of first-time funds identified through December 31, 2023.

MORE INFO:

Search fund transformations: A path to excellence

At a glance