IESE Insight

Corporate Venturing: A David-and-Goliath Collaboration

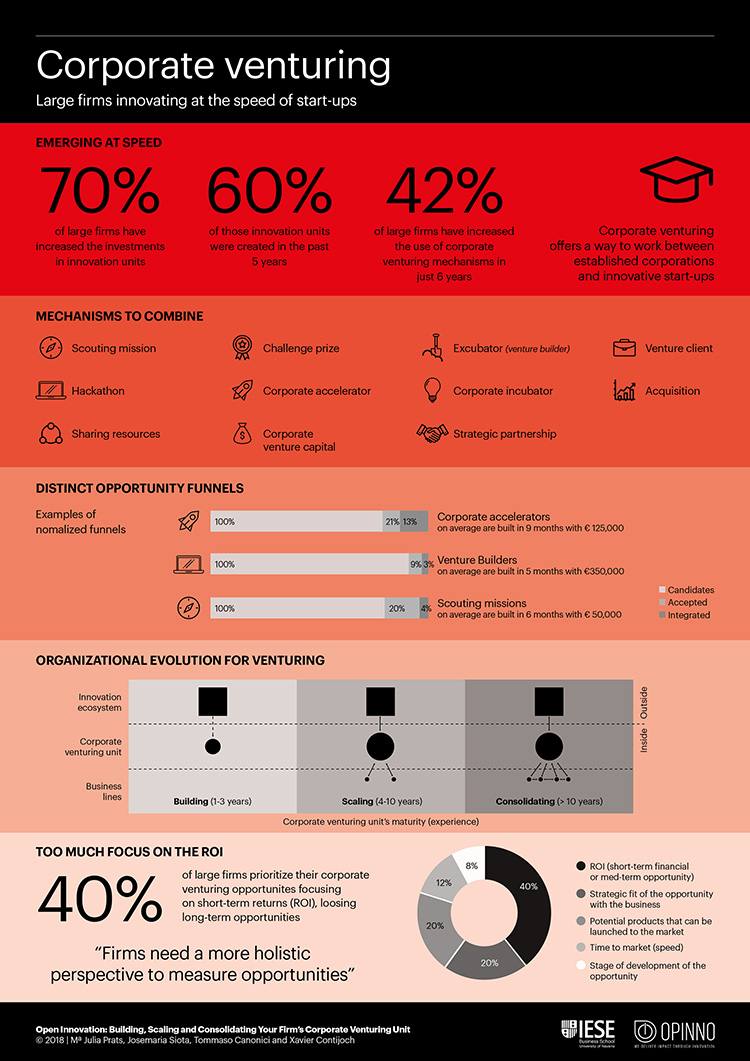

It's increasingly commonplace for large companies and startups to collaborate to achieve growth through innovation. So, how can businesses best take these projects through to fruition?

Corporate venture capital, scouting missions, hackathons, excubators, venture clients, corporate incubators and accelerators... These are just some of the models for collaboration between large companies and startups. The practice — known as corporate venturing — has been adopted by firms such as Siemens, GE, IBM, Xerox, Merck and Lucent.

There has been significant growth in the use of these types of mechanisms. In 2010, very few of the 210 largest companies by market capitalization worldwide used incubators and accelerators — compared to almost half of them just five years later.

So where should businesses start? How can they select the most suitable mechanism for collaboration? What sort of budget, time scale and objectives should they work with?

The report, titled Open Innovation: Building, Scaling and Consolidating Your Firm's Corporate Venturing Unit, based on interviews with the innovation directors of 44 large firms that already had a corporate venturing unit in place, addresses these sorts of questions.

The report is the work of professor Mª Julia Prats and Josemaria Siota from IESE's Entrepreneurship and Innovation Center, together with Tommaso Canonici and Xavier Contijoch from the consultancy firm Opinno.

Challenges and Opportunities

Collaboration between large companies and startups entails different challenges for each, given the significant and almost antagonistic differences in their characteristics and dynamics. However, these differences can also be complementary.

The main challenges for established companies are those related to intellectual property management, brand protection, financial stability and entrepreneurial culture.

For startups, difficulties most often arise in identifying the appropriate entry point for initiating the collaboration, understanding the role of different individuals and departments in a large corporation, dealing with long decision-making cycles, overcoming a fear of abusive negotiations, and resigning themselves to the fact that the large firm may neither comprehend nor recognize their way of working.

The Most Common Mechanisms

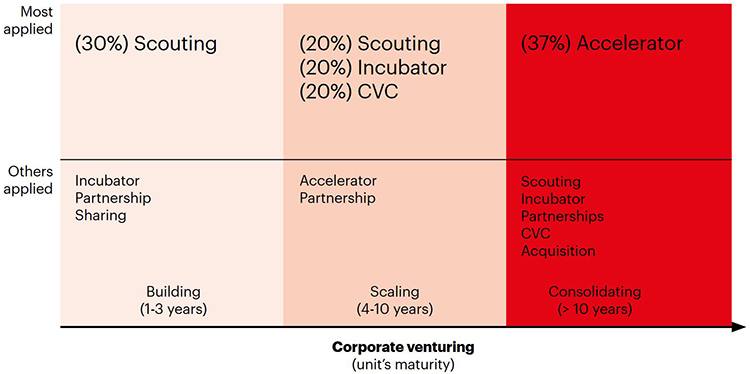

According to the report, most companies have diverse corporate venturing instruments. Corporate incubators (designed to attract and facilitate a relationship with startups) are usually common, though there are differences in the intensity of use of each mechanism and in the objectives pursued depending on how mature the unit is.

During the building phase, for example, the businesses analyzed opted for relatively low-cost mechanisms that could be rolled out quickly, such as scouting missions (30 percent). A few years later, during the scaling phase, these mechanisms were gradually superseded by more complex options such as incubators (20 percent) and corporate venture capital (20 percent). During consolidation, accelerators played a more important role in driving forward new projects (37 percent).

Selection Criteria

Choosing the most appropriate mechanism or combination of mechanisms for each stage is one of the keys to success. But what are the selection criteria?

Most of the businesses interviewed relied on strategic considerations, such as the level of innovation required (36 percent) or the time needed to validate the mechanism (14 percent). Only one in five businesses (22 percent) prioritized return on investment.

However, businesses most commonly measured the impact of a mechanism by its short and medium-term return (40 percent) instead of other indicators — such as, the strategic fit of the opportunity with the business (20 percent), the number of potential products which could be launched to the market (20 percent) or the required time-to-market (12 percent).

The researchers warn of an inconsistency which could create problems: companies that rely excessively on financial indicators may lose potentially lucrative long-term opportunities which have an unclear short-term return.

How Much, How Much, How Much...

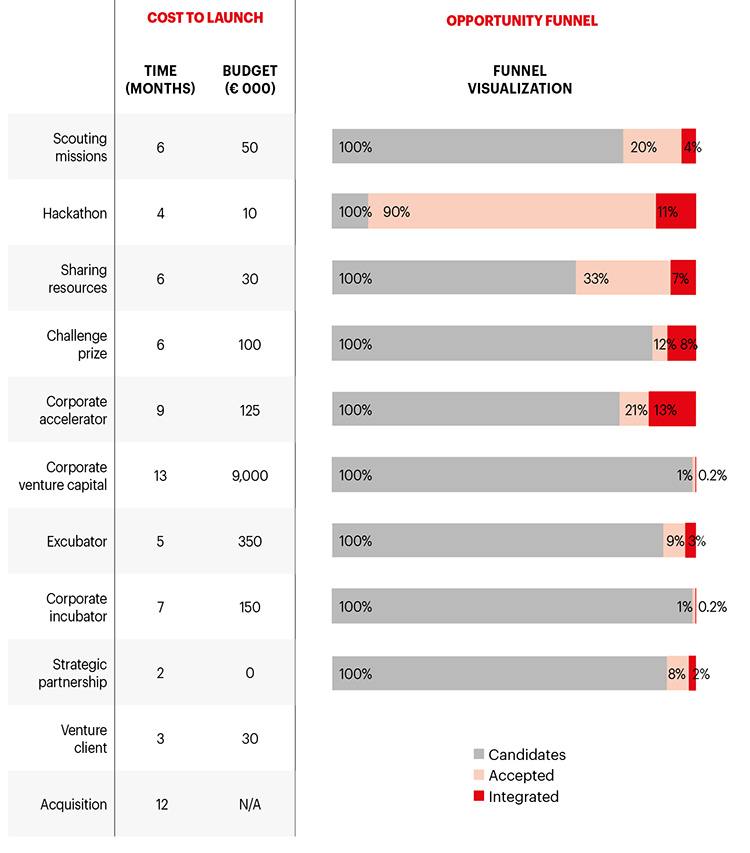

The average time to implement each mechanism varies. Some, such as scouting missions, can be launched fairly quickly (2-6 months), while others, such as corporate venture capital or acquisitions, usually take longer (12-13 months).

In terms of costs, the budget for most mechanisms is up to 350,000 euros, although corporate venture capital and acquisitions may entail much greater outlays.

Good Practice

According to the report, corporate venturing is a promising solution for generating innovative opportunities relatively quickly.

The authors stress that managers must adopt a strategic long-term outlook and consider the objectives and culture of the business when deciding on the most suitable type of collaboration. They also need to retain the interest and commitment of the startup by offering them a clear and, in some cases, tailored value proposition.

Methodology, Very Briefly

The report compiles the analysis of corporate venturing initiatives found in 44 large companies from eight different countries.