IESE Insight

Challenges and priorities for the banking sector in Spain

Scaling up in Europe and responding to global fragmentation are key items on the banking industry’s strategic agenda.

A survey of 81 banking professionals who attended the 20th IESE Banking event, organized by IESE Industry Meetings in collaboration with the IESE Center for International Finance (CIF) and under the academic direction of German Lopez Espinosa, identifies the main strategic challenges facing the sector in Spain in a context marked by geoeconomic reconfiguration, the green transition and digitalization.

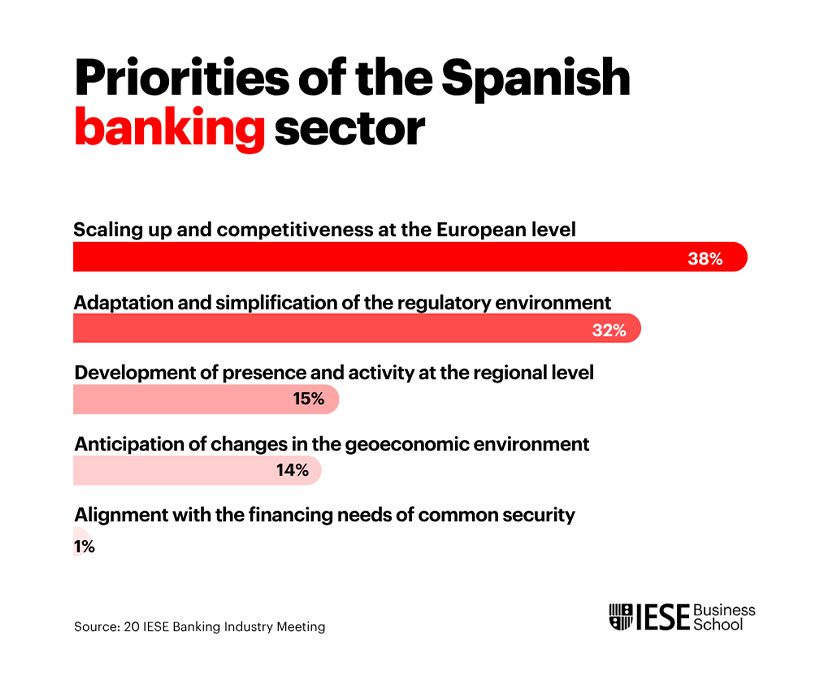

Scaling up and improving competitiveness at the European level was cited by 38% of respondents as their top priority, aiming to foster “banking champions” that strengthen the continent’s position. This was followed by adapting to the regulatory environment and contributing to its simplification (32%). Meanwhile, 15% highlighted the development of activity at the regional level. A slightly smaller 14% of professionals considered anticipating changes in the geoeconomic environment to be crucial. Lastly, only 1% mentioned aligning with the financing needs of European common security.

“These priorities reflect the strategic role that banking can play in Europe’s recovery, in advancing toward greater integration, and in initiatives such as euro-denominated bond issuance to attract international capital and strengthen the common currency,” says Lopez Espinosa.

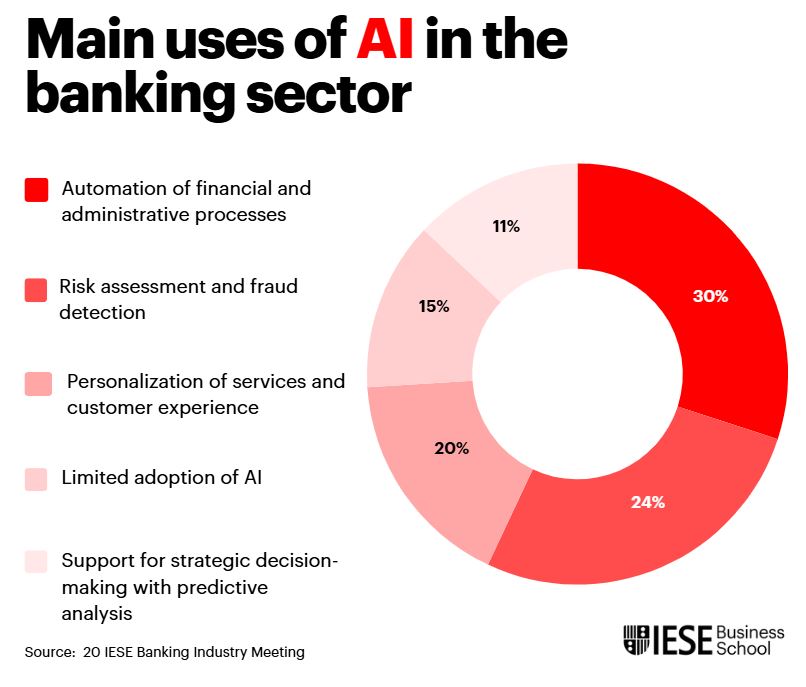

The survey also reveals the growing role of artificial intelligence (AI) in transforming banking. Thirty percent of respondents use AI to automate financial and administrative processes, 24% apply it for risk assessment and fraud detection, and 20% use it to personalize services and customer experience. Eleven percent cite its use in supporting strategic decision-making through predictive analytics. Still, 15% acknowledge that AI adoption in their organization remains limited.

The multiple applications of AI point toward a more efficient, secure and customer-centric banking model. Furthermore, the advancement of the digital euro project “reinforces the need to reduce fragmentation in payment systems, an area where technology will be key to achieving greater strategic autonomy,” concludes Lopez Espinosa.

READ ALSO:

5 lessons from Spain on banking success in uncertain times

How artificial intelligence is transforming finance

The Draghi report highlights that productivity must be the goal for Europe

15% off with the code INSIGHT15