IESE Insight

Key ideas in the global race for AI supremacy

Explosive new entrants like DeepSeek show that while the challenges for Europe are numerous, they are not insurmountable.

When the Chinese firm DeepSeek unveiled its new large language model (LLM) in January 2025, it signaled a new phase in the global race for AI supremacy. While U.S. companies have long dominated the tech landscape, China is rapidly closing the gap, with restrictions on hardware access fueling rather than hindering innovation.

As AI development takes on increasingly nationalistic overtones, it raises the question: does it ultimately matter who wins the race? Figures like Vinod Khosla, founder of Sun Microsystems, believes it does, equating AI’s significance to that of the nuclear bomb.

The stakes go beyond economics. AI’s ability to shape narratives and autonomously identify military targets raises profound sovereignty and security concerns. Tech equals power, and if concentrated in an undemocratic or unstable regime, the risks multiply.

Two recent sessions by IESE Prof. Sampsa Samila on DeepSeek and the geopolitics of AI explored these global tech dynamics and Europe’s role in the mix. Europe has a lot of ground to make up, though some of its biggest challenges may be internal — and surmountable.

Key factors in gaining competitive advantage

There is little inherent competitive advantage in LLMs, as their core technology is largely open source. What sets one model apart from another comes down to several key factors:

Scale. When it comes to geopolitical advantage, whether in technology or industry, bigger has always been better, and that remains true today. More data means better models, giving U.S. giants like Google and Meta, as well as Chinese state-affiliated firms, a clear edge, since they have unfettered access to vast datasets.

For Europe, closing this gap is challenging. Strict regulations like General Data Protection Regulation (GDPR) limit data access, and achieving the scale of U.S. and Chinese firms would require continent-wide AI models. This raises concerns over data sovereignty and involves the added obstacle of managing 24 official languages.

Meanwhile, the EU AI Act was Europe’s ambitious attempt to set the standards that the rest of the world would follow. However, at the AI summit in Paris in February 2025, the U.S. and U.K. conspicuously refused to sign a global pledge to adopt open, inclusive and ethical AI, with U.S. Vice President JD Vance criticizing Europe’s regulatory approach, saying it would only slow growth. “The hope for Europe leading in terms of setting global regulations has faded,” says Samila.

Speed. While large datasets are key, speed is just as crucial. The sooner a model reaches the market, the faster it accumulates data, compounding its advantage.

Cost plays a major role in speed. Once prohibitively expensive, AI model development is now far cheaper. Consider OpenAI’s reasoning models that were released between September and February: the performance improvement between ChatGPT’s o1 and o3 reasoning models grew significantly, but even more striking was that the cost of the o3 in February was 100th of what it was for the o1 just six months prior in September.

“This means that whatever ROI calculation you did in September is completely invalid in February,” says Samila. “In other words, whatever you may have discounted as not being profitable in September may now no longer be valid. The cost of these models is fast coming down, making business strategies that previously seemed impossible suddenly within reach.”

DeepSeek is a good example of this phenomenon: It claims to have trained its base model for just $5.6 million — a staggering 95% cost reduction compared with the hundreds of millions or even billions spent by U.S. firms. Samila notes this figure excludes salaries, infrastructure and prior research, so DeepSeek’s true cost was probably higher. Regardless, it proves that it’s imminently possible to disrupt the traditional powerhouses, even with resource constraints.

Hardware. Ideas spread easily, but hardware is another story. Computational power requires a lot of energy, which is why companies like Microsoft are exploring developing their own power stations to fuel their AI data centers. In this regard, European companies have the disadvantage of having such expensive energy, and investment in green alternatives is currently being stymied by the more urgent need to invest in defense.

The other bottlenecks when it comes to hardware are the graphics processing units (GPUs), the microchips and the photolithography machines used to make the chips, whose respective market leaders are currently U.S.-based Nvidia, Taiwan Semiconductor Manufacturing Company (TSMC) and the Dutch company ASML. “But somebody else, putting in a ton of money and learning faster, could catch up and challenge their dominant positions,” says Samila.

The warning for Europe is that, if ASML were replaced in the value chain, the most obvious competitor would come — again — from the United States, consolidating U.S. dominance in the tech sphere. As Samila explains, “It’s not good enough to have one market leader; you need to have a wider ecosystem that produces many market leaders.” More on this later.

Research remains fundamental

China has long been seen as an imitator rather than an innovator, but DeepSeek founder Liang Wenfeng believes it’s time for China to lead. Part of this leadership arises from China’s serious investment in research.

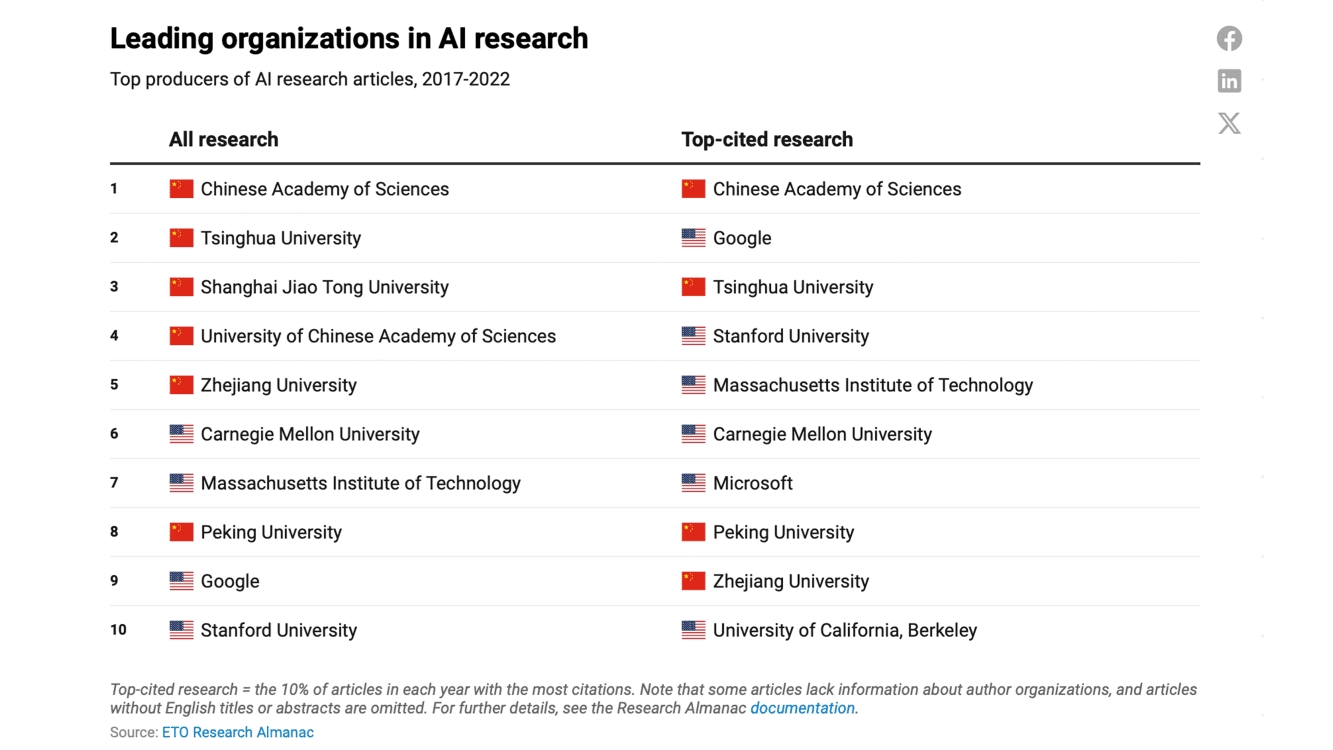

According to a Nature ranking, 7 of the top 10 research institutions are based in China. The Emerging Technology Observatory charts the growing number of English-language artificial intelligence articles that have at least one confirmed author from a Chinese organization.

The Global AI Talent Tracker shows China nearly matching the U.S. in producing elite AI researchers, with increasing numbers choosing to remain in or return to China.

This should serve as a wake-up call to Europe to invest in more research. Europe has no shortage of leading researchers, but they often head to the U.S. for better salaries and opportunities. Greater incentives are needed for them to stay.

Building an ecosystem: where the real value lies

Samila suggests Europe’s challenge isn’t necessarily research quality but slow adoption by startups in comparison with the U.S. Ironically, “the research that is done in Europe is often adopted faster by American companies,” he says.

Samila cites from his own research on the positive spillover effects of research adoption: “Startups tend to happen closest to where the research happens. It’s about having a whole ecosystem in place. Lots of money for research will create new product innovations, more patenting and more firm formation, and even more so if there is also a local venture capital ecosystem. Regions that have significant amounts of venture capital tend to spawn more new innovations, patents and startups out of that same amount of research investment.”

He is encouraged that Barcelona seems to be trying to move in this direction by creating a local innovation hub. It’s also part of the mission of IESE’s Entrepreneurship and Innovation Center (EIC).

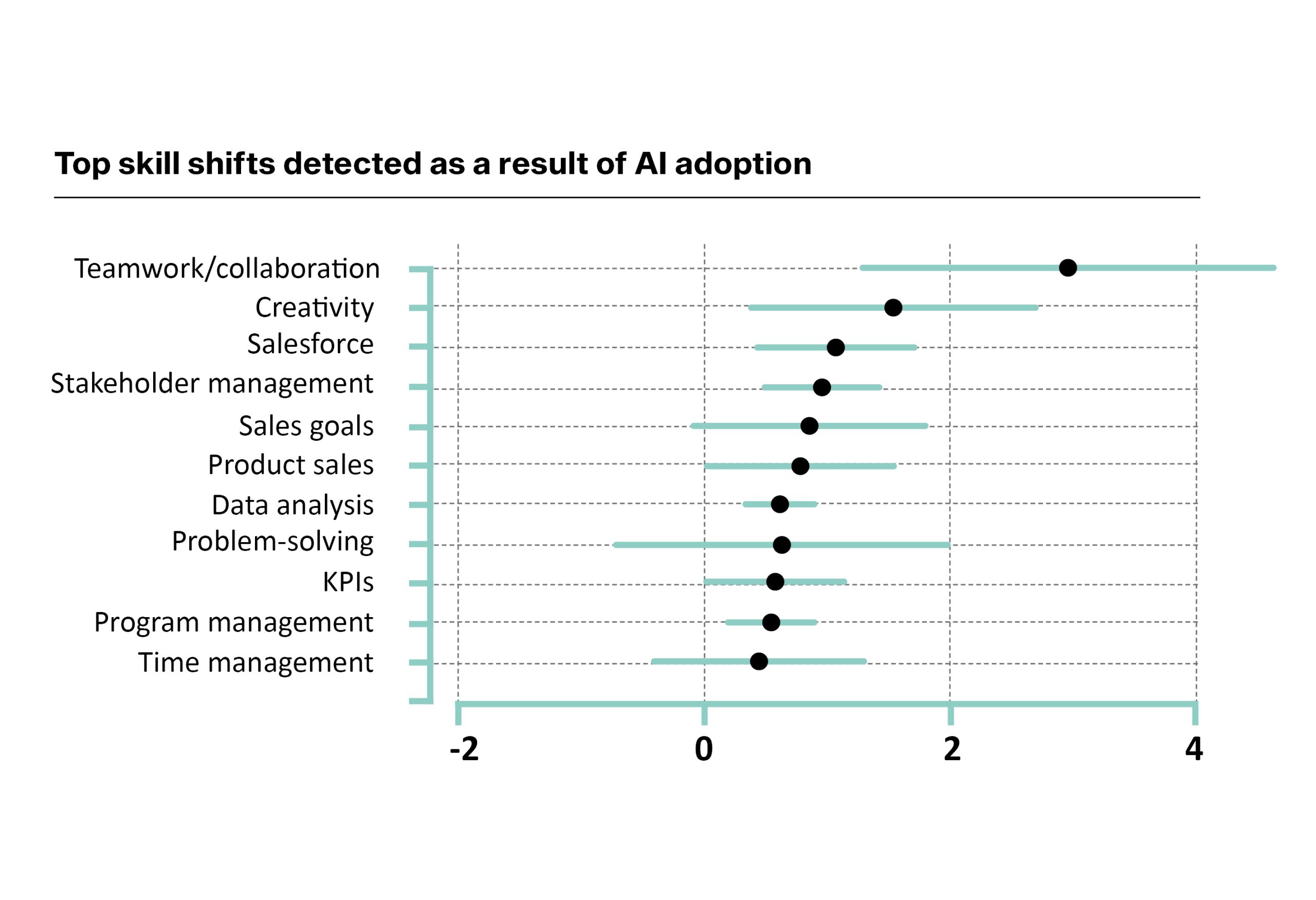

Equally important to building a European tech ecosystem akin to Silicon Valley is cultivating managers with AI skill sets, who can apply AI and take risks. Samila’s research (with Liudmila Alekseeva, José Azar and Mireia Giné) identifies the skill sets most in demand.

As entry barriers lower and costs drop, monopolizing AI becomes increasingly absurd. The real competitive edge may lie in commoditizing the complement; in other words, rather than seeking to monetize AI directly, businesses should use it to enhance other areas of value.

Platforms with large user bases now hold the power, and companies that control distribution and engagement will extract the most value from AI, regardless of whether they own or develop the models themselves.

This may explain why Meta, with its massive user ecosystem, remained relatively stable in the days following the arrival of DeepSeek, while Nvidia’s stock price took a hit. Similarly, Grok may lack an inherent competitive advantage, but integrated into Elon Musk’s X ecosystem, it becomes far more valuable.

For European companies, the questions are no longer “How much can AI be sold for?” or “Is there any point if we can’t do it first?” but rather “What new possibilities does it unlock?” and “Who dares to exploit those possibilities?”