IESE Insight

How corporate ESG disclosure has become a political lightning rod

For U.S. politicians, environmental, social and governance (ESG) disclosure regulations are uniquely polarizing.

Weeks before the 2024 presidential election, the U.S. House of Representatives voted to pass a Republican-sponsored bill that limited companies’ obligation to disclose information on areas such as climate risk and labor practices.

The bill, which never cleared the Senate, would have curtailed the Securities and Exchange Commission’s ability to mandate non-material disclosures and was widely considered a rollback of stricter environmental and social (E&S) rules. The legislation was entered into the public record under two names: the Guiding Uniform and Responsible Disclosure Requirements and Information Limits Act (GUARDRAIL Act) and the Prioritizing Economic Growth Over Woke Policies Act.

If it feels like political ideology permeates any debate over environmental and social disclosure rules for companies, that’s because it does.

A working paper by Gaizka Ormazabal and David Schröder of Copenhagen Business School explores how uniquely politicized E&S disclosure regulations have become, even compared to the fractious politics around other disclosure mandates and other environmental, social and governance (ESG) issues.

Ideology outweighs all else in ESG voting

The research looks at data on members of the U.S. House of Representatives from the 116th (2019-2020) and 117th (2021-2022) congressional sessions, examining the politicians’ actions at three key steps in the process of setting disclosure rules: when co-sponsoring bills, when voting on bills and when sending comment letters to the SEC during the implementation phase.

Each politician was rated on a scale of liberal (in the U.S. sense) to conservative, using the DW-Nominate score, the most widely used measure of political orientation in economics and political science.

The results: ideology played an outsized role in determining politicians’ behavior at every step of the political process. In fact, ideology was a more reliable predictor than other common drivers such as campaign contributions, a politician’s economic interests, public sentiment or social protests.

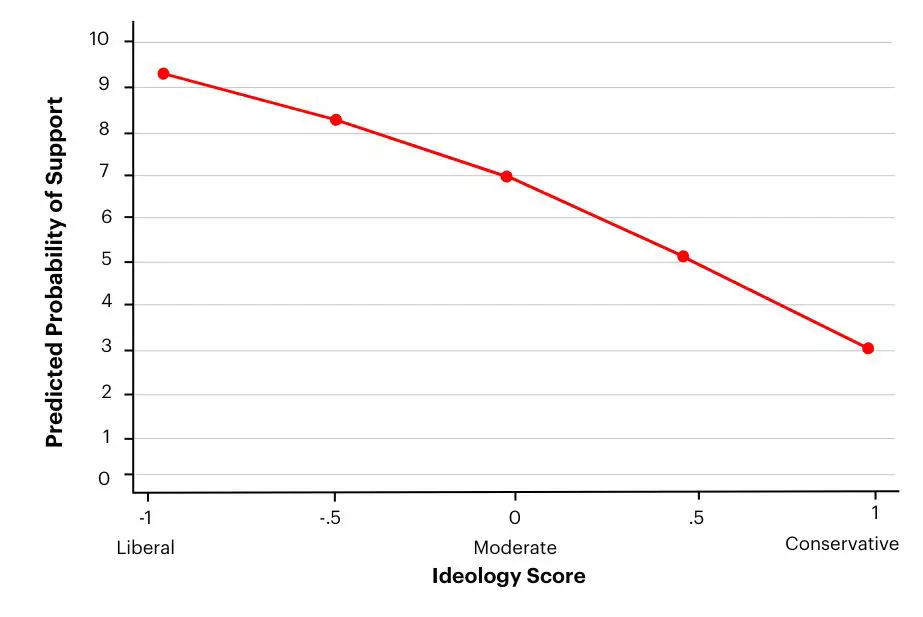

Support for E&S disclosure regulations by ideology

The most liberal lawmaker was approximately three times more likely to vote in favor of E&S disclosure regulations compared with the most conservative lawmaker. The most conservative lawmaker was four times more likely to comment to the SEC against E&S disclosure rules (specifically on climate disclosure) than the most liberal lawmaker.

Disclosure and ESG

For U.S. politicians, there was something uniquely triggering about the combination of corporate disclosure and E&S.

of votes on E&S disclosure rules

could be predicted by ideology, compared with 36% of the time for other types of disclosure regulations such as financial information or corporate governance rules.

Even actions on other environmental and social issues unrelated to disclosure — such as bills on coastline protections and gender violence — were less political. In votes on those types of measures, ideology seems to have had little impact on voting behavior; instead, factors such as constituent interests and campaign contributions appear to hold greater sway.

Why has E&S disclosure become so political?

There’s no single explanation for the politicization of E&S disclosure, but the data patterns do suggest some factors.

- Links to broader debates. Compared with financial issues, for example, E&S topics often intersect with broader political agendas such as climate change and labor rights, which are typically grounded in normative beliefs rather than purely economic reasoning.

- Tenuous economic arguments. Persuading other politicians to support or oppose an E&S proposal using largely economic arguments may be more difficult than in other regulatory areas. Many aspects of E&S are difficult to measure and lack standard metrics. The economic consequences of disclosure standards are complex and less transparent than those of other regulatory types, making it difficult for politicians to assess their impact.

- Less obtrusive path. Another element is that many left-of-center politicians tend to view disclosure mandates as a relatively quick and easy way to advance the E&S political agenda, prompting them to sponsor related legislation. Disclosure is often viewed as less intrusive than more direct regulatory interventions — such as caps on carbon emissions — to address environmental and social challenges.

And there’s no end in sight for the heightened polarization. Ideology-based voting increased by 15% over the study period, and in a follow-up, the researchers repeated their analysis for the GUARDRAIL Act in 2024. Since the bill was a proposed rollback, those who had voted in favor of greater disclosures now voted against it; those who voted against disclosure favored the reversal. The same deep ideological fissures remained, and six weeks later voters returned Donald Trump to the White House.

READ ALSO:

The Corporate Sustainability Reporting Directive: What every board needs to keep on the agenda

EU’s Sustainable Finance Disclosure Regulation linked to lower emissions, despite flaws

ESG-linked executive pay is on the rise, which is good news for the planet