MiM & MiF Pre-Screening Interview in London

The IESE MiF. What will you learn?

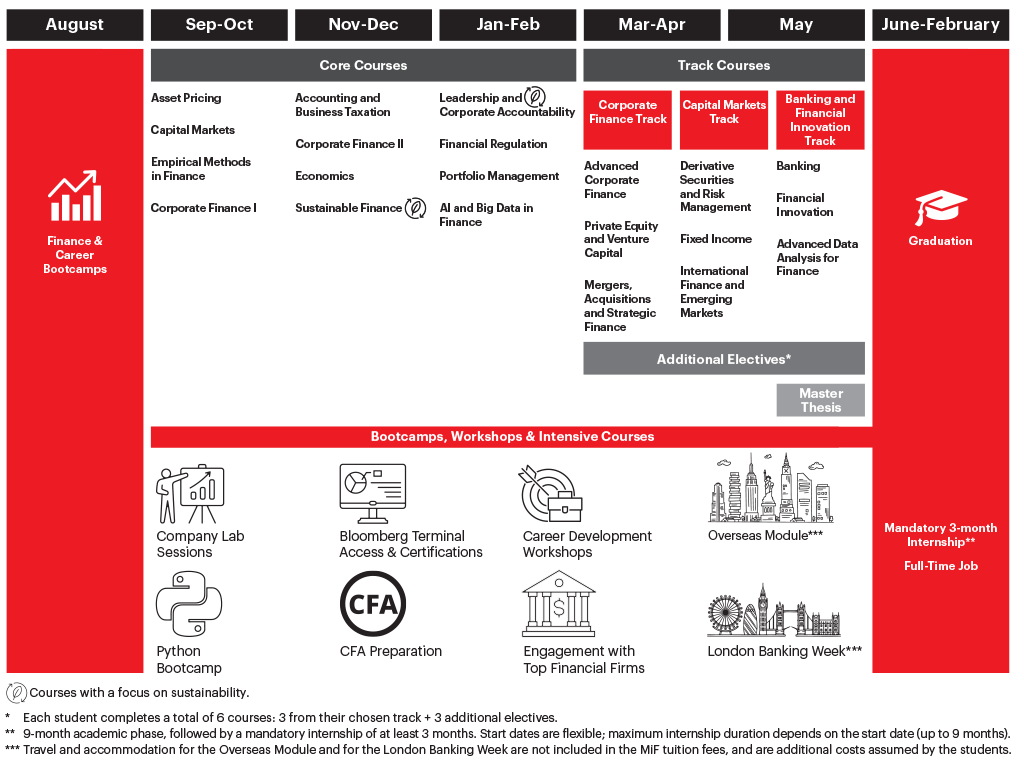

The IESE Master in Finance is an intensive, 9-month academic phase + mandatory internship, program designed to launch your career in the financial sector. Rooted in IESE’s values and general management approach, the MiF equips you not only with advanced technical and quantitative skills, but also with a strong ethical foundation and strategic perspective.

Through core courses in areas such as corporate finance, asset pricing, portfolio management, financial regulation and big data analytics, you develop the critical knowledge and tools to make complex financial decisions. The curriculum also emphasizes sustainability, personal finance and responsible leadership, ensuring you are prepared to lead in a world where finance and impact go hand in hand.

The program includes three specialized tracks – Corporate Finance, Capital Markets and, Banking and Financial Innovation – so you can tailor your learning to your career goals. You also take part in a hands-on international module in New York and a week in London in addition to completing a master thesis and an internship.

Beyond the classroom, you learn by doing: Analyzing real financial challenges, engaging with industry experts and developing the leadership mindset to navigate a constantly evolving global market.

Program Structure

MiF: Program Content.

The IESE Master in Finance is a transformative journey designed to prepare you for the challenges and opportunities of a rapidly evolving financial world.

With over six decades of experience in shaping global leaders, IESE brings together academic excellence, close industry connections and a values-driven approach to business. You benefit from IESE’s strong ties to Harvard, its global presence and a network that spans the financial world.

We’ve built a program that combines deep quantitative training with strategic thinking and ethical leadership. You’ll build your expertise – and your future – on solid ground.

Introduction

This course offers a structured introduction to financial accounting with a focus on how business transactions are recorded and how they flow into the main financial statements. Students learn to read and interpret income statements, balance sheets and cash flow statements, and to understand the accounting principles that underlie reported profits, assets, liabilities and cash flows. Building on the full accounting cycle from journal entries to financial statement preparation, the course also introduces selected advanced topics, such as leasing, bond accounting, consolidation and tax effects, that are particularly relevant for finance and investment professionals.

Objectives

By the end of the course, participants will be able to construct, interpret and analyse the three primary financial statements and understand the impact of key accounting decisions on reported performance and financial position. They will become familiar with core concepts such as accrual accounting, revenue recognition, inventory and fixed asset accounting, and the treatment of bonds, leases and deferred taxes. Participants will also gain a first exposure to consolidated financial statements and basic ratio analysis, equipping them with the accounting literacy needed to assess company performance, evaluate financial risk, and support valuation and credit analysis.

Introduction

This course offers a practical introduction to machine learning, with a focus on methods that are widely used in finance and business analytics. It starts from classical supervised learning, where models are trained on labelled data (for example, loan histories with “paid” or “default” outcomes), and introduces core algorithms such as decision trees, ensemble methods (random forests and gradient boosting) and k-nearest neighbours. The course also covers how to evaluate and tune models to ensure reliability, and provides an overview of pre-deep-learning techniques in natural language processing, equipping students to work with text data such as news, reports and corporate disclosures.

Objectives

By the end of the course, participants will understand the basic ideas behind supervised learning and be able to implement and interpret standard models such as decision trees, random forests and gradient boosting for structured data. They will know how to assess model performance using cross-validation, select and tune hyperparameters, and recognise the practical trade-offs between simplicity, accuracy and scalability. Participants will also gain familiarity with classical NLP tools (including TF-IDF, topic modelling, word embeddings, named entity recognition and sentiment analysis) and understand how these techniques can be applied to extract information from financial text and support data-driven decision-making in finance.

Introduction

This course explores how financial markets value risk and time across the main asset classes. We start from the building blocks of interest rates, term structures and risk premia, and use them to understand how bonds and stocks are priced in practice. Students learn to interpret yield curves, credit spreads and the cross-section of equity returns across sectors, geographies and investment styles. Throughout the course, we connect theory with data and real-world capital market developments, highlighting how asset pricing concepts underpin portfolio construction, performance evaluation and risk management.

Objectives

By the end of the course, participants will be able to explain the key drivers of bond and equity prices, interpret yield curves and credit spreads, and assess the risk–return profile of different asset classes. They will be able to apply modern portfolio theory to build and evaluate efficient portfolios, understand the role of diversification and correlation, and critically compare alternative portfolio construction approaches. Participants will also become familiar with the main asset pricing models, from CAPM to multi-factor frameworks, and learn how factor investing is implemented in practice through indices, funds and ETFs. Finally, they will gain an introduction to scenario analysis and market risk measures such as Value at Risk and Expected Shortfall, providing a practical toolkit for analysing and communicating investment risk.

Introduction

This course provides a comprehensive overview of how global capital markets are structured and how they function as a bridge between issuers and investors. We examine the full spectrum of markets and instruments, from equity and debt to money markets, securitization and derivatives, and analyse how primary issuance and secondary trading work in practice. Particular attention is paid to the role of investment banks, rating agencies, trading platforms and central banks in channelling savings, managing risk and transmitting monetary policy to the real economy.

Objectives

By the end of the course, participants will be able to describe the main segments of global capital markets and the instruments traded in each of them, and to distinguish clearly between primary and secondary markets and their respective processes. They will understand how equity and debt offerings are structured, how trading mechanisms and market microstructure affect liquidity and price discovery, and how money market and derivatives instruments are used for funding, hedging and speculation. Participants will also be able to interpret credit risk assessments and the role of rating agencies, and to explain how central bank actions interact with capital markets and financial intermediaries.

Introduction

This course examines how firms make key investment and financing decisions in order to operate, grow and create value for their stakeholders. We address questions such as how much to invest, which projects to undertake, how to finance them, and how to evaluate the financial health of the firm. Students are introduced to core concepts such as the time value of money, risk and return, capital budgeting, cost of capital and capital structure, while also developing practical tools to analyse financial performance and short-term funding needs.

Objectives

By the end of the course, participants will be able to interpret financial statements using ratio analysis and cash flow forecasting, and assess a firm’s profitability, liquidity and leverage. They will apply time value of money concepts and standard capital budgeting techniques (NPV, IRR, payback) to evaluate real investment projects under uncertainty, and estimate the cost of capital and WACC for corporate decisions. Participants will also understand the fundamentals of capital structure choices, the relationship between risk and return in corporate investments, and the role of working capital and short-term financing in supporting a firm’s sustainable growth.

Introduction

Building on the foundations of Corporate Finance I, this course focuses on advanced financial decision-making and its strategic implications for firms. It examines how companies value businesses and transactions, and respond to financial distress and changing market conditions. Special attention is given to mergers and acquisitions, leveraged buyouts, private equity and IPOs, highlighting how these transactions create (or destroy) value and reshape corporate ownership and governance. Throughout the course, students work with real cases that require integrated thinking across disciplines and the ability to communicate financial insights effectively to different stakeholders.

Objectives

By the end of the course, participants will be able to value companies and transactions using discounted cash flow and multiples, assess alternative financing structures, and analyse their impact on firm value and risk. They will understand the key steps in M&A, LBO and IPO processes, and be able to evaluate these transactions from the perspective of both managers and investors. Participants will also gain a deeper understanding of corporate governance, managerial incentives, dividend and payout policies, and the interaction between firms and financial markets in different macroeconomic environments, equipping them to design and execute coherent corporate financial strategies.

Introduction

Business leaders are frequently confronted with complex, unstructured problems that require judgment and action under conditions of uncertainty and risk. Unlike routine or well-defined problems, these situations do not have a single correct solution and often involve economic, technical, and human dimensions. The ability to address such problems effectively is a core managerial responsibility and a key differentiator of effective leadership.

Critical Business Thinking is a methodology-based course that introduces students to a proven approach, developed and refined by IESE faculty over more than 50 years, for dealing with unstructured managerial problems. The course equips participants with a systematic way of analyzing information, exercising sound judgment, and making timely decisions, particularly in contexts characterized by complexity, data abundance, and algorithmic tools. Beyond problem solving, the course emphasizes disciplined execution and the development of habits and skills that enable managers to act effectively and responsibly in real business situations.

Objectives

Diagnosing and solving real business problems forces managers to make decisions. Therefore, the main learning goal of this course is to improve the strategic decision-making process of the students. By the end of the course participants will be able to identify unstructured problems and use the process for solving them and taking action. They will be able to work with the three level criteria (economic, organizational, and personal – anthropological or ethical) that are involved in every business situation.

As this course is one of the most “open ended” in the first period, additional objectives are to introduce students to the dynamics of the case method and report preparation. As many students come from different educational traditions and some have been a few years in business, our experience is that many students need to get their mind around the case method itself in order to get the most out of the entire program. Learning through cases is a unique process and part of the objective of Critical Business Thinking is to present participants with real life, everyday business situations they can immediately.

Introduction

This course provides a compact yet rigorous foundation in microeconomic and macroeconomic principles for students pursuing advanced training in finance. It focuses on the economic logic that underpins firm behaviour, market dynamics and the policy environment in which financial decisions are made. The micro part of the course examines how prices are formed, how firms compete under different market structures, and how strategic interactions shape outcomes. The macro part introduces the main drivers of business cycles, inflation, interest rates and exchange rates, with a particular emphasis on the role of central banks, fiscal policy and global capital flows in shaping financial market conditions.

Objectives

By the end of the course, participants will be able to apply core micro- and macroeconomic principles to interpret financial market behaviour and assess the economic context of business decisions. They will understand supply and demand dynamics, firm behaviour under competition, monopoly and oligopoly, and the sources of market efficiency and market failures, including basic tools from game theory for analysing strategic interaction. Participants will also be able to read and interpret key macroeconomic indicators, understand the transmission of monetary and fiscal policy, and evaluate issues such as sovereign debt sustainability, exchange rate movements and international capital flows, thereby strengthening their ability to connect economic developments to valuation, risk and investment decisions.

Introduction

These courses provide a compact yet rigorous foundation in microeconomic and macroeconomic principles for students pursuing advanced training in finance. They focus on the economic logic that underpins firm behaviour, market dynamics and the policy environment in which financial decisions are made. The micro part of the courses examine how prices are formed, how firms compete under different market structures, and how strategic interactions shape outcomes. The macro part introduces the main drivers of business cycles, inflation, interest rates and exchange rates, with a particular emphasis on the role of central banks, fiscal policy and global capital flows in shaping financial market conditions.

Objectives

By the end of the courses, participants will be able to apply core micro- and macroeconomic principles to interpret financial market behaviour and assess the economic context of business decisions. They will understand supply and demand dynamics, firm behaviour under competition, monopoly and oligopoly, and the sources of market efficiency and market failures, including basic tools from game theory for analysing strategic interaction. Participants will also be able to read and interpret key macroeconomic indicators, understand the transmission of monetary and fiscal policy, and evaluate issues such as sovereign debt sustainability, exchange rate movements and international capital flows, thereby strengthening their ability to connect economic developments to valuation, risk and investment decisions.

Introduction

This course provides a hands-on introduction to the empirical tools used to analyse financial markets and corporate behaviour. Starting from the stylised facts of financial data (returns, volatility and non-normality) it develops a toolkit that spans regression analysis, time-series and panel econometrics, volatility modelling and event-study methods. The emphasis is on linking econometric techniques to concrete questions in asset pricing, risk management and corporate finance, and on implementing these methods with real data using statistical software.

Objectives

By the end of the course, participants will be able to apply linear and logistic regression to problems such as return prediction and credit risk, estimate and interpret linear factor models (CAPM and multifactor models) and evaluate portfolio performance using standard risk–return metrics. They will know how to specify and estimate time-series models (AR, MA, ARMA) and volatility models (ARCH/GARCH and extensions), compute and backtest market risk measures such as Value at Risk and Expected Shortfall, and work with regularised machine learning methods (LASSO, Ridge, Elastic Net) for high-dimensional prediction. Participants will also be able to conduct yield curve analysis using principal components, implement panel data techniques for corporate finance and asset pricing applications, design and test event studies, and assess model quality through out-of-sample forecasting and rolling-window evaluation.

Introduction

This course provides a structured introduction to the regulatory frameworks that govern financial institutions, markets and instruments. It examines how regulation responds to market failures and systemic risk, and how capital, liquidity, disclosure and conduct rules shape the behaviour of banks, investment firms and other financial actors. With a focus on both prudential and conduct regulation, the course reviews the main post-crisis reforms and highlights the regulatory logic and enforcement mechanisms used across key jurisdictions.

Objectives

By the end of the course, participants will be able to explain the economic rationale for financial regulation, including issues such as market failures, systemic risk and contagion. They will understand core elements of prudential rules (such as Basel III capital and liquidity requirements and macroprudential tools) and conduct regulation and investor protection (including MiFID II, disclosure and transparency standards). Participants will also become familiar with regulatory approaches to digital finance and algorithmic decision-making, the role of supervisory processes and enforcement, and current trends in global coordination and regulatory innovation, enabling them to interpret regulatory developments and assess their impact on financial decision-making.

Introduction

This course introduces students to the governance factors that are relevant for understanding, assessing, and judging value and risk in financial institutions. The course does not adopt a normative, legalistic, or compliance-driven approach, nor does it aim to train students in the direct practice of corporate governance. Its focus is on examining how organizational purpose, the definition of the business and its boundaries—priorities and risks—and the ways in which key decisions are made and overseen, through appropriate governance structures and checks and balances, shape long-term institutional sustainability. The course broadens students’ perspectives on the deeper functioning of financial institutions and the specific challenges associated with their governance.

Objectives

The primary objective of the course is to broaden students’ perspectives and to incorporate into their analysis key governance factors that are essential for evaluating companies and financial institutions from an institutional sustainability standpoint, beyond purely technical or financial considerations. The course does not seek to teach students “how to govern,” but rather to help them understand the types of criteria, tensions, and responsibilities involved in the governance of these organizations. The study of governance in financial institutions also makes visible the kinds of knowledge, prudential judgment, and skills required for the responsible exercise of leadership in this context. In this sense, the course adopts an integrative approach that goes beyond the technical, incorporating financial, geopolitical, social, and sustainability dimensions, and is oriented toward the development of a holistic rather than purely instrumental form of judgment.

Introduction

This course examines the broader responsibilities of financial and business leaders operating in a global, high-stakes environment. It focuses on how leaders make decisions at the intersection of economic performance, legal obligations and ethical accountability, especially in situations marked by ambiguity, conflict or crisis. Using real-world cases, students analyse situations in which executives must balance competing pressures from shareholders, regulators, employees and society, and reflect on what it means to exercise responsible leadership in finance and beyond.

Objectives

By the end of the course, participants will be able to identify leadership challenges that go beyond technical correctness and apply structured ethical reasoning to complex decisions. They will understand the three pillars of corporate accountability (legal, ethical and economic), fiduciary duties and stakeholder trade-offs, as well as the role of corporate governance, board dynamics and organisational culture in shaping behaviour. Participants will also be better prepared to manage reputational risk, respond to crises, and articulate a personal framework for purpose, trust and integrity in financial leadership.

Introduction

This course focuses on how to design, implement and evaluate investment strategies in real-world capital markets. Building on prior coursework in asset pricing, quantitative methods and data analysis, it covers both passive and active portfolio management across asset classes. In the first part, students learn how to construct and analyse diversified portfolios, work with factor models and benchmarks, and implement strategic and tactical asset allocation. The second part turns to active strategies in equities, fixed income and hedge funds, integrating insights from behavioural finance and fundamental analysis.

Objectives

By the end of the course, participants will be able to construct and evaluate multi-asset portfolios using modern factor investing and optimization techniques, taking into account realistic frictions such as transaction and execution costs. They will understand how to design strategic and tactical asset allocation decisions based on macroeconomic and business-cycle conditions, and how to manage global and currency exposures. Participants will be able to analyse and implement active equity and fixed-income strategies, apply tools such as the Black–Litterman model, and critically assess a range of hedge fund approaches.

Introduction

Managers in financial institutions often underestimate the role that politics and power play in organizational life. In complex and highly regulated environments, power is a central driver of coordination, change, and strategic execution, making the ability to understand and navigate organizational politics as critical as technical or financial competence. This course examines three core components of power in organizational settings: the origins of power, the ways in which different sources of power can be developed, and how power can be exercised to increase individual influence and promote change within financial institutions.

Objectives

The overarching objective of this course is to help participants develop their political skills as managers within financial institutions. The course provides insight into individual capabilities related to personal, positional, and relational sources of power, and fosters the development of skills that enable effective action in organizational settings. Particular emphasis is placed on understanding the balance between cooperation and competition in complex institutions, and on cultivating the attitudes and competencies required to pursue desired outcomes in a responsible and effective manner.

Introduction

This course offers a practical introduction to machine learning, with a focus on methods that are widely used in finance and business analytics. It starts from classical supervised learning, where models are trained on labelled data (for example, loan histories with “paid” or “default” outcomes), and introduces core algorithms such as decision trees, ensemble methods (random forests and gradient boosting) and k-nearest neighbours. The course also covers how to evaluate and tune models to ensure reliability, and provides an overview of pre-deep-learning techniques in natural language processing, equipping students to work with text data such as news, reports and corporate disclosures.

Objectives

By the end of the course, participants will understand the basic ideas behind supervised learning and be able to implement and interpret standard models such as decision trees, random forests and gradient boosting for structured data. They will know how to assess model performance using cross-validation, select and tune hyperparameters, and recognise the practical trade-offs between simplicity, accuracy and scalability. Participants will also gain familiarity with classical NLP tools (including TF-IDF, topic modelling, word embeddings, named entity recognition and sentiment analysis) and understand how these techniques can be applied to extract information from financial text and support data-driven decision-making in finance.

Introduction

This course provides a hands-on introduction to the empirical tools used to analyse financial markets and corporate behaviour. Starting from the stylised facts of financial data (returns, volatility and non-normality) it develops a toolkit that spans regression analysis, time-series and panel econometrics, volatility modelling and event-study methods. The emphasis is on linking econometric techniques to concrete questions in asset pricing, risk management and corporate finance, and on implementing these methods with real data using statistical software.

Objectives

By the end of the course, participants will be able to apply linear and logistic regression to problems such as return prediction and credit risk, estimate and interpret linear factor models (CAPM and multifactor models) and evaluate portfolio performance using standard risk–return metrics. They will know how to specify and estimate time-series models (AR, MA, ARMA) and volatility models (ARCH/GARCH and extensions), compute and backtest market risk measures such as Value at Risk and Expected Shortfall, and work with regularised machine learning methods (LASSO, Ridge, Elastic Net) for high-dimensional prediction. Participants will also be able to conduct yield curve analysis using principal components, implement panel data techniques for corporate finance and asset pricing applications, design and test event studies, and assess model quality through out-of-sample forecasting and rolling-window evaluation.

Introduction

This course examines how sustainability considerations are reshaping financial markets, investment decisions and corporate strategies. It focuses on how environmental, social and governance (ESG) factors affect risk, return and value creation, and how investors and firms are adapting to evolving expectations from regulators, clients and society at large. Combining financial analysis with institutional and regulatory insights, the course equips students to interpret ESG data, understand the design of sustainable financial instruments and critically assess the promises and limitations of ESG integration.

Objectives

By the end of the course, participants will be able to explain the main ESG definitions, frameworks and metrics, and evaluate the financial materiality of sustainability-related risks and opportunities. They will understand how ESG considerations are incorporated into portfolio construction and investment processes, and how instruments such as green bonds, sustainability-linked loans and climate-aligned finance are structured and used. Participants will also be able to navigate ESG ratings and disclosure standards, interpret key regulatory initiatives (such as TCFD and CSRD), and critically assess issues like greenwashing, standardisation and impact measurement, enabling them to judge the credibility and effectiveness of ESG strategies from both an investment and corporate finance perspective.

Banking and Financial Innovation Track

Introduction

This course analyses the role of banks in the financial system and their impact on firms, households and the real economy. It focuses on how banks create value through intermediation, maturity transformation and risk management, and how their business models are shaped by competition, technology, regulation and monetary policy. Students learn to read and interpret bank balance sheets and income statements, understand key sources of profitability and fragility, and examine episodes of banking stress and crisis to see how vulnerabilities build up and unwind. The course also discusses current developments such as digital banking, fintech challengers and changing funding and lending patterns.

Objectives

By the end of the course, participants will be able to explain the core functions of banks, the structure of their assets and liabilities, and the main drivers of bank profitability and risk. They will understand the management of credit, liquidity and interest rate risk, and how capital and funding decisions affect resilience and growth. Participants will be able to analyse bank performance using standard metrics, assess lending and pricing policies, and evaluate how regulation and monetary policy influence bank behaviour. They will also be equipped to discuss strategic challenges facing the banking sector, including competition from non-bank intermediaries and digital platforms, and to identify key indicators of vulnerability and strength in individual institutions and banking systems.

Introduction

This course introduces advanced machine learning techniques that are transforming data analysis in finance, with a focus on deep learning, large language models (LLMs) and reinforcement learning. Students learn how neural networks, convolutional architectures and sequence models capture complex non-linear patterns in financial data, and how transformer-based LLMs can be used to work with text, time series and structured information. The course emphasises concrete financial applications, from summarising earnings calls and analysing news sentiment to detecting fraud, classifying regulatory filings and extracting trading signals, and explores how “agentic” LLMs can not only generate text but also interact with data, tools and workflows. It also covers reinforcement learning for dynamic decision-making in areas such as algorithmic trading, portfolio management and pricing.

Objectives

By the end of the course, participants will understand the basic building blocks of modern deep learning and how they can be applied to financial text, time series and transaction data. They will be able to describe how LLMs are trained, fine-tuned and prompted, and evaluate use cases such as earnings call summarisation, sentiment analysis and document classification in a financial context. Participants will also gain an introduction to reinforcement learning concepts like Q-learning and the exploration–exploitation trade-off, and see how these methods can be used for trading, asset allocation and dynamic pricing. Throughout, they will be encouraged to reflect on interpretability, bias and model risk, including the use of tools such as SHAP values to explain black-box models and assess their reliability in high-stakes financial applications.

Introduction

This course examines how technological innovation is transforming financial services, with a particular focus on fintech and crypto-based business models. It explores how new entrants and established institutions use data, digital platforms and blockchain technology to challenge traditional lending, payments, trading and investment activities. Students are introduced to the economics of financial intermediation and market inefficiencies that create opportunities for innovation, and then dive into concrete developments such as marketplace lending, crowdfunding, digital payments, robo-advisory, cryptocurrencies and blockchain-based applications. Throughout, the course combines conceptual frameworks with real-world cases and industry perspectives to help students separate enduring innovations from hype.

Objectives

By the end of the course, participants will be able to explain the main drivers of the fintech and crypto “revolutions” and understand how new technologies and data analytics reshape financial products, business models and competitive dynamics. They will gain a working knowledge of key areas such as digital lending and consumer finance, payment innovations, trading and investing platforms, as well as the economic and technological underpinnings of blockchain, cryptocurrencies and related applications. Participants will be equipped to evaluate opportunities and risks in financial innovation, assess the viability of new ventures and use cases, and critically reflect on issues such as scalability, regulation, governance and the current limitations of fintech and crypto solutions.

Capital Markets Track

Introduction

This course introduces the main derivative instruments used in modern financial markets and shows how they are applied to manage risk. Starting from risk-free rates and the no-arbitrage principle, we analyse forwards, futures, swaps and options, and study how their prices are linked to underlying assets, interest rates and dividends. Students learn how futures and options are traded, how margining and collateral work, and how simple and more advanced hedging strategies are constructed in practice. Building on binomial models and the Black-Scholes-Merton framework, the course develops a practical intuition for option prices, the Greeks, implied volatility and the use of exotic options and interest-rate derivatives in risk management.

Objectives

By the end of the course, participants will be able to describe and compare the key features of forwards, futures, swaps and options, and to value standard derivative contracts using no-arbitrage arguments, binomial trees and the Black-Scholes-Merton model. They will understand payoff structures, option strategies and arbitrage relations, and be able to design basic hedging programmes for equity, commodity and interest-rate exposures, including the use of futures, options, FRAs and swaps. Participants will also gain familiarity with the Greeks and implied volatility as tools for measuring and managing risk, and will implement selected pricing and hedging techniques in Python, providing a hands-on foundation for more advanced derivatives and risk management work.

Introduction

This course provides an in-depth overview of fixed income markets and their role in financing governments, firms and households. It focuses on how different instruments are structured, issued, traded and used by investors and intermediaries. The course covers the main segments of the market – from sovereign and corporate bonds to money market instruments and securitised products such as mortgage-backed and asset-backed securities – and examines how yield curves, credit spreads and liquidity conditions reflect macroeconomic forces and market sentiment. Emphasis is placed on understanding real-world market practices, trading conventions and the institutional architecture of fixed income markets, including the role of central banks and dealers.

Objectives

By the end of the course, participants will be able to describe and compare the key types of fixed income instruments and understand how they are issued, priced and traded in primary and secondary markets. They will learn to interpret yield curves, term premia and credit spreads as indicators of macroeconomic expectations and credit risk, and to use standard measures such as duration and convexity to discuss interest rate risk and basic portfolio strategies. Participants will also gain familiarity with the structure and risks of securitisation conduits and mortgage markets, and be able to analyse fixed income markets around episodes of stress or regime change, equipping them to link fixed income developments to broader financial and macroeconomic conditions.

Introduction

This course offers a broad introduction to international financial systems and the macro-financial dynamics of emerging markets. It examines how cross-border capital flows, exchange rate regimes and global monetary policies interact, and how these forces shape risks and opportunities for investors, firms and policymakers. Particular emphasis is placed on understanding the structural features of developing economies, from financial development and institutional quality to exposure to external shocks, and on how these features influence sovereign and currency risk, market volatility and investment returns.

Objectives

By the end of the course, participants will be able to analyse balance of payments and current account dynamics, compare exchange rate regimes and understand the mechanisms behind currency crises. They will be familiar with key parity conditions (PPP, interest rate parity), the international transmission of monetary policy and the use of FX hedging instruments. Participants will also learn to assess sovereign debt issuance and pricing, evaluate country and sovereign credit risk, including the role of rating agencies and multilateral institutions, and apply these insights to design emerging market investment strategies and global macro allocations.

Corporate Finance Track

Introduction

This course builds on the core corporate finance sequence to analyse complex financial decisions at the intersection of valuation, reporting and incentives. It focuses on situations where standard tools such as simple DCF or basic capital structure models are not enough, and where the quality of financial information and the design of contracts play a central role. Students examine advanced valuation methods, real options, hybrid financing instruments and value-based management frameworks, while also assessing how opacity, complexity and accounting choices affect the measurement of performance and firm value.

Objectives

By the end of the course, participants will be able to value projects and firms using real options and advanced earnings-based approaches such as residual income, and to critically evaluate the quality and reliability of financial statements. They will understand value-based management metrics (such as ROIC, EVA and related KPIs) and how they link operating decisions to shareholder value. Participants will also be able to analyse the role of hybrid securities (convertible debt, preferred equity, mezzanine capital) in financing policy, and to think systematically about incentive design, financial contracting and restructuring in complex corporate settings.

Introduction

This course examines how financial decisions shape corporate strategy and long-term value creation, with a particular focus on mergers and acquisitions (M&A). It explores why firms pursue acquisitions, divestitures and equity issues as part of their growth plans, and how these transactions are structured, priced and financed. Students work through real cases to see how capital market players, managers and investors interact around major strategic events, and to understand the practical challenges of aligning financial choices with competitive strategy.

Objectives

By the end of the course, participants will be able to value companies using a range of methods and assess the merits and risks of proposed M&A transactions under different scenarios. They will understand the mechanics of IPOs and seasoned equity offerings, and how financing choices support or undermine a firm’s growth strategy and risk–return profile. Participants will also learn to critically evaluate corporate decisions from a long-term value perspective, recognise how capital markets influence strategic options, and design coherent financial strategies that support sustainable competitive advantage.

Introduction

This course examines how entrepreneurial ventures and established companies are financed and transformed through venture capital and private equity. It follows the full investment cycle, from sourcing and assessing opportunities, to structuring deals, creating value and ultimately exiting investments. Students are introduced to the economics and organisation of the VC/PE industry, including the roles of general partners (GPs) and limited partners (LPs), and work through real cases and investment documents to see how financial analysis and qualitative “soft factors” jointly shape investment decisions in start-ups, growth companies and buyouts.

Objectives

By the end of the course, participants will be able to assess new venture and buyout opportunities, value privately held companies and understand the key terms and structures used in entrepreneurial finance and PE/VC transactions. They will learn how fund managers conduct due diligence, identify and prioritise risks and opportunities, and align financial and contractual terms with value-creation plans and exit routes. Participants will also gain a holistic view of how the VC/PE industry functions and develop the judgment needed to evaluate deals and financing choices in entrepreneurial and private equity settings.

Top international faculty

IESE’s faculty includes full-time and part-time professors. All full-time professors have PhDs from prestigious universities. They are also highly international, representing more than 20 nationalities, and bring vast relevant expertise from the highest levels of business.

Faculty members serve on diverse corporate boards and publish their research in leading academic journals, combining real-world experience with pioneering academic insights.

IESE professors have an “open-door” policy and provide you with invaluable mentoring and guidance. They cultivate rich exchanges of ideas that make the most of the combined experiences in your classroom.

The Case Method and our connection with Harvard Business School

In 1963, Harvard Business School formed an alliance with IESE Business School and IESE adopted the famous HBS case method learning methodology. Over the years, IESE professors began writing their own cases, making their own impact and becoming thought leaders in their own right.

These are some examples of how IESE’s case method is applied:

- You will engage in dynamic discussions about the business challenges you face on a daily basis.

- You will combine individual learning, team discussions and dialogue in an interdisciplinary plenary session.

- The lecturer will facilitate and guide the debate, encouraging everyone’s participation to enrich the discussion with different points of view and experiences.

Read more about the case method and a few examples used in IESE classes of real cases of leading companies.

The IESE Experience

At IESE, you’ll be surrounded by talented peers, supported by a world-class faculty, and challenged by real-life business cases. We’ll put you to the test so that you can reach your full potential.

Discover the benefits of the IESE experience.

IESE Rankings.