Loans and scholarships

Welcome to IESE’s Financial Aid Office

Completing a Master in Finance (MiF), Master in Management (MiM), MBA, Executive MBA, Global Executive MBA, PhD or Executive Education program is one of the best possible investments in personal and professional growth. As such, deciding how to finance studies calls for rigorous planning. We collaborate with public and private institutions to offer exclusive opportunities to our students, although of course they are also free to explore other sources of funding.

IESE’s Financial Aid Office is dedicated to helping students find the best financing options available to you. Thanks to years of accumulated experience built with help from student feedback, we are able to guide them through the options and help select the best option for their specific needs.

IESE Scholarships for all programs

Most MiF scholarships at IESE are merit-based, meaning that they are awarded for outstanding academic and professional achievements. Current scholarships are listed here.

IESE Excellence Scholarship

This scholarship is awarded to the top performers in our application process and recognizes their outstanding achievements, personal merit and strong fit with IESE’s values.

IESE Diversity Scholarship

IESE is committed to creating a diverse community for our students. This scholarship supports exceptional candidates from under-represented nationalities or unique profiles who can contribute positively to the classroom learning experience.

IESE Ambassadors Scholarship

The IESE Ambassadors Scholarship awards 20 to 30 scholarships to students with outstanding academic records, excellent professional experience and personal merit. These students have exemplified a strong fit with IESE’s values.

IESE Women in Finance Scholarship

In our quest to shape a brighter, more inclusive world, IESE is aware of the unique value that women offer, and therefore we committed to increasing the number of women in leadership roles. These scholarships support talented women with a track record of outstanding academic or/and professional accomplishment.

In addition to the Women in Finance Scholarships, we also offer a Post-Graduation Payment Aid. This is a payment model designed to support talented women who may face financial constraints. Please click here for further information.

IESE Social Impact Scholarship

IESE values students who have made a significant social impact through their personal or professional experience. These scholarships are awarded to those who have made an outstanding contribution to society, by being involved in the non-profit sector or have helped to solve social or environmental issues.

IESE Social Entrepreneurship Scholarship

IESE awards one scholarship covering 10-50% of the tuition fee to a recently graduated student with relevant experience in social entrepreneurial projects and a strong desire to have a positive impact in the world.

IESE Women in STEM Talent Scholarship

IESE supports students who have a strong background in science or technology and have the potential to drive innovation and technological advancements in their communities. These scholarships award applicants who have shown interest and aptitude in areas such as big data, digital transformation, programming and artificial intelligence.

IESE Legacy Scholarship

The IESE MiF program offers select scholarships available to the immediate family of IESE alumni and current students. To be eligible for a Legacy Scholarship, an applicant must have at least one parent or sibling who is an alumni or current student. The applicant must have a strong academic record, high leadership potential and excellent personal merit to be considered.

IESE’s Young Christian Leaders Scholarship

These scholarships are awarded to young individuals who have made an outstanding contribution to society through their social and cultural dedication within their communities, promoting the core values of the Christian message.

We recommend that you describe the specific activities, along with the institutions and the duration of your involvement with them when submitting your scholarship application.

IESE Young Leaders in Africa Scholarship

IESE awards up to 3 scholarships covering up to 90% of the MiF tuition fees. To be eligible, candidates must be nationals of Africa and have outstanding academic records, leadership potential and personal merit.

IESE Young Leaders in Emerging Markets Scholarship

The MiF program welcomes professionals from developing economies. These scholarships support outstanding candidates who live and work in a developing country.

Fundación Princesa de Girona Scholarships

The Fundación Princesa de Girona Scholarships aim to provide support in all critical aspects of youth development and offer assistance in overcoming the barriers young people face when integrating into society and contributing to its benefit.

To this end, the Fundación Princesa de Girona scholarship program is specifically aimed at promising talented students, between the ages of 20-24, who are Spanish or residents of Spain, and who meet the requirements established by Spanish legislation to access the regulated studies of the program they apply for.

IESE Young Italian Talent Scholarship – Fondazione RUI

IESE awards scholarships covering up to 50% of the tuition fee to Italian students with academic excellence and strong commitment to their country.

Heinrich J. Klein Foundation Scholarship – External Scholarship

The objective of the Heinrich J. Klein Foundation is to sponsor science and international exchange by granting scholarships to people during their training and further education period.

The Board of Trustees of the HJK Foundation selects the applicants and defines the amount of funding the person receives (the decision will be made in June/July each year). Submit your application directly to the HJK Foundation here.

IESE International Foundation Scholarship Program

With the help of donations from alumni, partner companies and friends of IESE, each year the foundation awards several scholarships to high-potential students. These students demonstrate a commitment to social development, human-centered values, academic excellence and leadership skills, with special priority given to candidates from low- and middle-income countries.

Within its Scholarship Program, the Foundation has the following named scholarships:

- Bartolomé-Carreño Scholarship: open to candidates from any country, but preferably participants from rural or sparsely populated areas.

- Bosch Aymerich Foundation Scholarship: open to candidates graduated in Architecture or Engineering, with good academic records and limited resources.

- Martínez Carrasco Family Scholarship

- Nemesio Díez Foundation Scholarship: open to candidates of Spanish and/or Mexican nationality, with an excellent academic record and/or limited financial resources.

- Prof. Fernando Pereira Scholarship: open to candidates with outstanding academic records (that obtained the highest GMAT score or equivalent test) and the best academic and professional resume. Candidates must share the humanistic values of the institution, promoted by Professor Pereira: commitment to society, diversity, and social inclusion.

Application process

Due to the continuous admissions process, scholarships are granted on a rolling basis – therefore, you will increase your chances of receiving a scholarship the sooner you apply!

All scholarship candidacies require one cover letter within the application.

Most MiM scholarships at IESE are merit-based, meaning that they are awarded for outstanding academic and professional achievements. Current scholarships are listed here.

IESE Excellence Scholarship

This scholarship is awarded to the top performers in our application process and recognizes their outstanding achievements, personal merit and strong fit with IESE’s values.

IESE Diversity Scholarship

IESE is committed to creating a diverse community for our students. This scholarship supports exceptional candidates from under-represented nationalities or unique profiles who can contribute positively to the classroom learning experience.

IESE Ambassadors Scholarship

The IESE Ambassadors Scholarship awards 20 to 30 scholarships to students with outstanding academic records, excellent professional experience and personal merit. These students have exemplified a strong fit with IESE’s values.

IESE Women in Management Scholarship

In our quest to shape a brighter, more inclusive world, IESE is aware of the unique value that women offer, and therefore we committed to increasing the number of women in leadership roles. These scholarships support talented women with a track record of outstanding academic or/and professional accomplishment.

In addition to the Women in Management Scholarships, we also offer a Post-Graduation Payment Aid. This is a payment model designed to support talented women who may face financial constraints. Please click here for further information.

IESE Social Impact Scholarship

IESE values students who have made a significant social impact through their personal or professional experience. These scholarships are awarded to those who have made an outstanding contribution to society, by being involved in the non-profit sector or have helped to solve social or environmental issues.

IESE Social Entrepreneurship Scholarship

IESE awards one scholarship covering 10-50% of the tuition fee to a recently graduated student with relevant experience in social entrepreneurial projects and a strong desire to have a positive impact in the world.

IESE Women in STEM Talent Scholarship

IESE supports students who have a strong background in science or technology and have the potential to drive innovation and technological advancements in their communities. These scholarships award applicants who have shown interest and aptitude in areas such as big data, digital transformation, programming and artificial intelligence.

IESE Legacy Scholarship

The IESE MiM program offers select scholarships available to the immediate family of IESE alumni and current students. To be eligible for a Legacy Scholarship, an applicant must have at least one parent or sibling who is an alumni or current student. The applicant must have a strong academic record, high leadership potential and excellent personal merit to be considered.

IESE’s Young Christian Leaders Scholarship

These scholarships are awarded to young individuals who have made an outstanding contribution to society through their social and cultural dedication within their communities, promoting the core values of the Christian message.

We recommend that you describe the specific activities, along with the institutions and the duration of your involvement with them when submitting your scholarship application.

IESE Young Leaders in Africa Scholarship

IESE awards up to 3 scholarships covering up to 90% of the MiM tuition fees. To be eligible, candidates must be nationals of Africa and have outstanding academic records, leadership potential and personal merit.

IESE Young Leaders in Emerging Markets Scholarship

The MiM program welcomes professionals from developing economies. These scholarships support outstanding candidates who live and work in a developing country.

Fundación Princesa de Girona Scholarships

The Fundación Princesa de Girona Scholarships aim to provide support in all critical aspects of youth development and offer assistance in overcoming the barriers young people face when integrating into society and contributing to its benefit.

To this end, the Fundación Princesa de Girona scholarship program is specifically aimed at promising talented students, between the ages of 20-24, who are Spanish or residents of Spain, and who meet the requirements established by Spanish legislation to access the regulated studies of the program they apply for.

IESE Young Italian Talent Scholarship – Fondazione RUI

IESE awards scholarships covering up to 50% of the tuition fee to Italian students with academic excellence and strong commitment to their country.

Heinrich J. Klein Foundation Scholarship – External Scholarship

The objective of the Heinrich J. Klein Foundation is to sponsor science and international exchange by granting scholarships to people during their training and further education period.

The Board of Trustees of the HJK Foundation selects the applicants and defines the amount of funding the person receives (the decision will be made in June/July each year). Submit your application directly to the HJK Foundation here.

IESE International Foundation Scholarship Program

With the help of donations from alumni, partner companies and friends of IESE, each year the foundation awards several scholarships to high-potential students. These students demonstrate a commitment to social development, human-centered values, academic excellence and leadership skills, with special priority given to candidates from low- and middle-income countries.

Within its Scholarship Program, the Foundation has the following named scholarships:

- Bartolomé-Carreño Scholarship: open to candidates from any country, but preferably participants from rural or sparsely populated areas.

- Bosch Aymerich Foundation Scholarship: open to candidates graduated in Architecture or Engineering, with good academic records and limited resources.

- E. Arocena Foundation Scholarship: open to Mexican candidates.

- Family Lamsfus Bravo: open to candidates with excellent academic records, preferably from the Valencian Community (ideally the Ribera Alta region) or, if not possible, from Spain.

- Martínez Carrasco Family Scholarship

- Nemesio Díez Foundation Scholarship: open to candidates of Spanish and/or Mexican nationality, with an excellent academic record and/or limited financial resources.

- Prof. Fernando Pereira Scholarship: open to candidates with outstanding academic records (that obtained the highest GMAT score or equivalent test) and the best academic and professional resume. Candidates must share the humanistic values of the institution, promoted by Professor Pereira: commitment to society, diversity, and social inclusion.

Application process

Due to the continuous admissions process, scholarships are granted on a rolling basis – therefore, you will increase your chances of receiving a scholarship the sooner you apply!

All scholarship candidacies require one cover letter within the application.

A wide range of scholarships are available to incoming IESE MBA students. IESE scholarship applications should be completed and submitted within the MBA application form to the Admissions Department.

Current scholarships are listed here.

IESE Excellence Scholarship

This scholarship is awarded to the top 7-10% of our admitted students and recognizes their outstanding academic and/or professional achievements, personal merit and strong fit with IESE’s values. IESE Excellence Scholars will benefit from special engagement with senior leadership at IESE, connecting with other excellence scholars that are part of this exclusive pool and will have the opportunity to share their ideas on developing our program for future students.

IESE Leaders in Sustainability & Responsible Business Scholarship

This scholarship supports applicants who have shown a high level of achievement and passion in leading sustainable business causes and have made significant social impact through their professional experience. They have the potential to inspire others as champions of sustainability and responsibility.

Recipients will have the opportunity to connect with IESE’s Institute for Sustainability Leadership (ISL) and to participate in our flagship student conference focusing on Sustainability, Doing Good Doing Well.

IESE Trust Scholarship

The IESE Trust awards 20 to 30 scholarships to students with outstanding academic records, excellent professional experience and personal merit. These students have exemplified a strong fit with IESE’s values.

Forté Fellowship

Forté Fellowships are open to all female applicants. Candidates should exhibit exemplary leadership through academic, team, community and creative leadership. Candidates should demonstrate a commitment to women and represent diverse educational and work backgrounds, career goals, ethnicities and citizenship. The maximum amount of the scholarship is one year’s tuition fees.

IESE Women in STEM (Science, Technology, Engineering and Math) Scholarship

This scholarship is meant for women who have a background in STEM or who have significant accomplishments in this field. They have the potential to serve as advocates to encourage and strengthen female representation in STEM.

IESE Women in Management Scholarship

This scholarship supports exceptional female applicants who have 5 years of work experience or more, have attained managerial experience and have demonstrated exceptional leadership qualities.

IESE Future Female Leaders Award Scholarship

The Future Female Leaders Award (FFLA) recognizes women who embody IESE’s mission, with the objective of connecting them with one another and helping them realise their potential. FFLA awardees who apply for IESE’s full-time MBA program and excel in the application process are eligible for scholarships ranging from 5,000 euros up to 50,000 euros upon enrolling. You can refer to this brochure for more details.

IESE Dignity, Diversity and Belonging (DDB) Scholarship

IESE is committed to creating a diverse and inclusive environment for everyone. Our Dignity, Diversity and Belonging (DDB) Office seeks to promote this environment, where everyone can flourish. This scholarship supports exceptional candidates from unique, under-represented backgrounds or have been involved in efforts to promote inclusion and can contribute positively to the classroom learning experience.

IESE Leaders in Africa Scholarship

IESE awards up to three scholarships covering up to 80% of the MBA tuition fees. To be eligible, candidates must be nationals of Africa and have demonstrated exceptional academic and professional achievements and personal merit. This scholarship is available to those who apply within our R1, R2 & R3 application deadlines.

IESE Leaders in Emerging Markets Scholarship

The MBA program welcomes professionals from developing economies. These scholarships support outstanding candidates who live and work in a developing country.

IESE Entrepreneurship Scholarship

These scholarships are awarded to professionals who have displayed a high level of entrepreneurial spirit, creativity and resilience. Applicants should demonstrate a proven track record of entrepreneurship and a commitment to contribute to the entrepreneurial ecosystem at IESE through the Entrepreneurship and Innovation Center (EIC) and the Startup & Entrepreneurship Club.

IESE Technology & Innovation Scholarship

IESE supports professionals who have a strong background in science or technology and have the potential to drive innovation and technological advancements in their communities. These scholarships award applicants who have shown expertise in areas such as big data, digital transformation, programming and artificial intelligence.

IESE Leaders in Non-Profit & Public Sector Scholarship

This scholarship is primarily for applicants who have dedicated their careers to non-profit or government organizations, helping people on a societal level.

IESE Family Scholarship

IESE welcomes students with families and grants scholarships for students who, in the opinion of the Scholarship Committee, deserve financial aid.

IESE Alumni Association Scholarship

The IESE Alumni Association awards five scholarships covering up to 50% of tuition fees for the first and second year of the MBA program. These scholarships are for MBA students who have demonstrated exceptional work experience and personal merit.

IESE Young Talent Path Scholarship

These scholarships are awarded to our Young Talent Path (YTP) candidates. IESE’s YTP is our early admissions pathway for young professionals with less than 2 years of work experience and who are committed to pursuing their MBA at IESE. Successful YTP candidates who meet our GMAT/GRE criteria are automatically awarded a scholarship upon enrolling in the MBA.

UNAV Alumni Scholarship

We’re pleased to announce that, to commemorate the 60th anniversary of the first MBA graduating class, IESE Business School is offering a €15,000 scholarship for UNAV undergraduate and master’s alumni interested in pursuing an MBA program next year. For more information, you can request feedback on your profile, and the Associate Directors will be happy to assist you.

IESE International Foundation Scholarship Program

Supported by donations from alumni, partner companies and friends of IESE, the Foundation awards, each year, numerous scholarships to high potential students with a proven commitment to social development and humanistic values, academic excellence, and leadership skills, giving a special priority to those coming from countries eligible for development aid.

Within its Scholarship Program, the Foundation has the following named scholarships:

- Alonso-Stuyck Family Scholarship: open to candidates from emerging economies or who might need special financial support.

- BC Nonwovens Scholarship: open to women from developing countries with limited financial resources.

- Bosch Aymerich Foundation Scholarship: open to candidates with a background in entrepreneurship or those actively engaged in the entrepreneurial field. Applicants should demonstrate strong academic performance and financial need.

- E. Arocena Foundation Scholarship: open to Mexican candidates.

- Herberto Gut Scholarship: devoted to Latin women.

- IESE Foundation UK Scholarship: open to British students or those coming from the Commonwealth with broad professional experience. Students must prove their potential to contribute to IESE’s mission in the future and live the values of leadership and social inclusion.

- Jiménez Jaso Family Scholarship: open to all candidates with a special focus on candidates from Navarra.

- Nemesio Díez Foundation Scholarship: open to candidates of Spanish and/or Mexican nationality, with an excellent academic record and/or limited financial resources.

- Prof. Fernando Pereira Scholarship: open to candidates with outstanding academic records (have obtained the highest GMAT score or equivalent test) and the best academic and professional resume. Candidates must share the humanistic values of the institution, promoted by Professor Pereira: commitment to society, diversity, and social inclusion.

- Stanley A. Motta Scholarship: open to candidates from Latin America.

In this video, IESE MBA Admissions Director, Patrik Wallén, walks you through the step-by-step process to apply for scholarships at IESE. From eligibility criteria to insider tips on how to strengthen your application, Patrik shares his insights to help you make the most of this opportunity.

Guidelines

- Generally, IESE MBA scholarships are merit-based, meaning that they are awarded based on outstanding academic and professional achievements. The GMAT or GRE score also plays an important role in securing a successful application.

- Individual scholarships typically range from 10% to 50% of tuition fees. Please note that living expenses are not covered by any of the scholarships. In exceptional cases, candidates may be awarded a combination of scholarships (e.g., Forte Fellowship + Family scholarship).

- We have a specific pool of need-based scholarships, mainly for candidates from emerging markets. We recommend that candidates with exceptional financial circumstances provide a clear explanation in the scholarship cover letter and include any relevant supporting documentation. These candidates may be asked to provide documentation such as income tax returns, proof of salary, bank statements for the past 3 months, medical care records, etc.

- We discourage candidates who are fully company sponsored from applying for scholarships, as our scholarships are exclusively intended to support those with financial limitations.

Application process

- All scholarship applicants are required to complete one scholarship essay to be submitted along with their MBA Application. Candidates can select up to 3 scholarships they deem fit for them, but ultimately the admissions committee will determine the scholarship type to grant.

- We require that candidates who intend to apply for a scholarship complete a scholarship essay and submit it together with the MBA application Form. The scholarship application will only be considered after they have been accepted into the program and does not affect the admissions outcome.

- The Scholarship Committee usually meets once for every round of applications. The Committee reviews each application and awards successful candidates with a specific scholarship.

- When possible, scholarship decisions are announced together with the admissions decisions. Certain scholarships are awarded at a later date, but no later than June 30.

IESE offers a scholarship program for promising Executive MBA students capable of making a positive and significant impact on business and society. Current scholarships are listed here.

Excellence Scholarship

Scholarships will be awarded to those students who demonstrate academic merit together with an outstanding professional background.

Woman Talent Scholarship

Scholarships available to women with a high leadership potential.

Entrepreneurship Scholarship

Scholarships will be awarded to entrepreneurship students who have launched or are launching a new business.

Fundación Princesa de Girona Scholarships

The Fundación Princesa de Girona Scholarships aim to provide support in all critical aspects of youth development and offer assistance in overcoming the barriers young people face when integrating into society and contributing to its benefit.

To this end, the Fundación Princesa de Girona scholarship program is specifically aimed at promising talented students, between the ages of 20 and 35, who are Spanish or residents of Spain, and who meet the requirements established by Spanish legislation to access the regulated studies of the program they apply for.

Mitsubishi Entrepreneurship Scholarship

Support for entrepreneurs who have started or are developing a new business. With the collaboration of Mitsubishi Electric.

IESE and ONCE Foundation Scholarships

IESE and the ONCE Foundation grant unique annual scholarships of up to 65% of tuition fees to people with disabilities who wish to study the Executive MBA. The scholarships are offered to people with a legally recognized disability of at least 33%, who must present a copy of their disability certificate and fill out a scholarship application form in order to be evaluated. A committee made up of members of the ONCE Foundation and IESE’s EMBA will select the candidates. The deadline for submitting the application is June 1st, and the scholarship awards will be announced one month later.

Application process

Candidates already admitted in the Executive MBA are eligible to apply for a scholarship. Special consideration will be given to those who are experiencing difficult financial situations.

- Candidates are required to submit the scholarship application form within the established deadlines. Admitted students should fill out the specific scholarship application form (Barcelona / Madrid / Munich / São Paulo) in order to be evaluated.

- Candidates may apply for more than one category, but only one scholarship per candidate will be awarded.

- Candidates who withdraw before the start of the program may defer their admission, but their scholarship may not be deferred.

The Scholarship Award Committee

Committee members base their decisions on the following criteria:

- Academic merit (including the candidate’s GMAT score or IESE admissions test)

- Experience and leadership skills in his or her professional field

- Impact on his or her company and on society

- Entrepreneurial initiative, capacity for innovation and international track record

- Admissions interview evaluation

We offer a range of scholarships for the Global Executive MBA program to managers, executives and entrepreneurs who have demonstrated the potential to make a positive impact on the global business community.

IESE is particularly interested in contributing to the development of:

- entrepreneurs and innovators who can create economic and social value.

- women who lead and inspire.

- public sector leaders who contribute to shaping society.

- business leaders in growth markets with the skills and expertise to grow their companies.

- senior executives of global organizations who seek to fulfill their real potential in leadership positions.

Current scholarships are listed here.

Women in business scholarship

These scholarships, covering up to €40,000, are awarded globally. Open to female candidates with significant experience in management roles and currently holding or aspiring to hold a leadership position in either the private or public sector.

Global leader scholarship

These scholarships, covering up to €40,000 are awarded globally. Applicants should be leaders working or intending to work in a global context, be it public or private, corporate or entrepreneurial. They must have significant experience in management roles and currently holding or aspiring to hold a leadership position in the private or public sector.

Eligibility

Candidates must already be admitted to the IESE Global Executive MBA program to be eligible for a scholarship. Upon admission, eligible candidates will be invited to apply for the scholarship of their choice.

- Admitted candidates who are fully or partially sponsored by their companies are not eligible for scholarships.

- Applications can only be submitted for one specific scholarship.

- Although admission to the program is deferrable, scholarships are not.

The Scholarship Award Committee

The Scholarship Award Committee is made up of prestigious business leaders and IESE alumni who actively collaborate with the school. Committee members base their decisions on the following criteria:

- Academic merit

- Leadership experience

- Impact on his/her company and society

- Admissions interview evaluation

IESE Business School offers a range of scholarships for the AMP and PMD programs to CEOs, C-suite executives, functional managers and entrepreneurs who have financial restrictions but have demonstrated the potential to make a positive impact on the global business community.

Current scholarships are listed here.

Women in Leadership Scholarship

To support women with a track record of outstanding professional accomplishment. Three awards that cover up to 20% of the tuition fee are available in every edition of the program.

Entrepreneurship Scholarship

To support entrepreneurs and innovators who can create economic and social value. Two awards that cover up to 15% of the tuition fee are available in every edition of the program.

Development Scholarship

To support participants from non-profit organizations (NGOs) and IESE associated schools in their efforts to have a positive impact in the world. One award that covers up to 50% of the tuition fee are available every academic year.

Global Support Scholarship

To support candidates impacted by recent and ongoing global events. There are awards that cover up to 10% in each program edition.

Guidelines

- Scholarship applicants must already be admitted to one of the General Management Programs to be eligible.

- Candidates who are fully or partially sponsored by their companies are not eligible for scholarships.

- Scholarship applications can only be submitted for a specific program. This means that, once awarded, a scholarship can only be used for the chosen program.

- Although admission to the program is deferrable, scholarships are not.

The Scholarship Award Committee

The Scholarship Award Committee is made up of prestigious business leaders and IESE alumni who actively collaborate with the school. Committee members base their decisions on the following criteria:

- Academic merit

- Significant career development

- Personal challenges overcome

- Impact on his/her company and on society

- Admissions interview evaluation

Other financial aid for general management programs

Military (USA) (available for AMP only)

IESE Business School is committed to supporting U.S. military service members and veterans to take on leadership roles in the business world. Whether just beginning to think about their transition from active duty or already moving forward, it is essential that service members capitalize on the skillset that they have developed in the armed forces.

Tax Benefits for Education

Spain (PIF)

PIF is an economic incentive offered to companies who allow their employees to pursue higher education. It is applicable under Spanish legislation for any employee that is actively paying into the Spanish social security system. Contact us for more information.

Other Countries

Please contact the corresponding authorities in your home country to confirm if any tax benefits apply.

IESE Business School and MIT Sloan offer a range of scholarships for the Global CEO Program to senior executives and entrepreneurs who have financial restrictions but have demonstrated the potential to make a positive impact on the global business community.

There are three awards available every academic year which each cover up to 15% of the tuition fee:

Women in Business Scholarship to support women with a track record of outstanding professional accomplishment.

Entrepreneurship Scholarship to support entrepreneurs and innovators who can create economic and social value.

Emerging Markets Scholarship to support candidates coming from emerging economies.

IESE’s Focused Programs offer a wide variety of scholarships for entrepreneurs, executive women and NGO leaders.

Contact us to find out more about eligibility and how to apply.

Post-Graduation Payment Aid (PPA) for the MBA, MiF and MiM

IESE´s Post-Graduation Payment Aid (PPA) is designed for high-achieving students who may not currently have the financial means to fund their MBA, MiF or MiM studies. Made possible through the European Union’s InvestEU Fund, the PPA allows eligible candidates to pay a portion of their tuition fees as a fixed percentage of their income over up to 10 years (*) after graduation. This is not a traditional loan, but an alternative financing model known as an income share agreement, offering flexibility and peace of mind to students who may otherwise find it challenging to cover tuition costs upfront.

The PPA fosters financial confidence through support from the EU, which covers potential payment shortfalls to ensure program continuity. This support enables IESE to help talented students pursue their education without immediate financial pressure, while underscoring the importance of repayment as students’ contributions help future participants benefit from the same assistance.

Detailed information on eligibility and the application process will be provided to admitted MBA, MiF and MiM candidates.

(*) Repayment terms may vary based on each candidate’s profile.

Other sources of funding

In addition to IESE’s scholarships and Post-Graduate Payment Aid (PPA), many candidates finance their studies through scholarship and loan programs funded and administered by external organizations. Though IESE does not administer or select for these organizations, we are ready to support students in any aspect of their application process. Some foundations also rely on IESE to carry out an initial screening of candidates.

Candidates can find additional financing options in our search engine.

Browse Financial Aid Search EngineMore options for MBA students

MBA private loans

MBA public loans

Additional MBA funding

Haven’t found what you’re looking for?

Financing recommendations

1. Explore and analyze all financial options for financing your IESE program.

2. Get several rate quotes on loans and compare them in order to choose the best offer.

3. Check your local finance providers and consider taking out a loan in your local currency. Take into account exchange rate fluctuations, which may impact your loan repayment in the future.

4. Check out our financial aid search engine to see different financing options.

5. Prepare a spreadsheet of your living costs and tuition fees, including the loan payments. Be aware that some loans require monthly payments during the study period. These payments can be interest only or principal plus interest.

6. Prepare all documents required for securing a loan before leaving your home country and bring them to Barcelona.

7. Apply for your loans as early as possible. Full-time MBA students should secure funding and send financial plan to the Financial Aid Office before July 15.

8. For Spanish loans and other banking operations, obtain your NIE (Spanish residence permit) as soon as you arrive in Barcelona.

9. Remember that IESE’s Commitment and Reservation Fees are not covered by loans offered at IESE.

10. All full-time MBA students should send their financial plan, according to dates provided by the Financial Aid Office.

11. Take into account that loan amounts and interest rates depend on the risk profile of each candidate: a student’s loans, debt and savings, along with country risks such as an exchange rate volatility.

1. Establish a good, stable relationship with your loan/scholarship provider. Whether it’s a bank or private lender, know who your contact person is and keep your contact data updated, especially when leaving Barcelona.

2. Make sure you know your (monthly) tuition payment due dates and the exact amount of each payment. In the case of loans, make sure that the bank has all relevant information and is transferring the funds by the deadline.

3. Pay tuition according to the school tuition deadline.

4. If you opt for the Sabadell Bank loan, remember to sign the loan in October (first week) and not before. From that moment, you will begin pay interesting and your deferment period will start.

5. For the Sabadell Bank loan, check that you have authorized the bank to send payments for the second-year tuition.

6. For the U.S. federal loans, remember to check restrictions on the international module in New York, internship and exchange program in the U.S. and any other ineligible schools.

7. If your loan is in a different currency than your national currency, take measures to ensure future payments regardless of exchange rate fluctuations.

1. Comply with the loan repayment schedule. If you’re going to miss a payment for any reason, be proactive and work with the lender in advance to find solutions before it triggers any legal procedure against you.

2. School loan conditions for incoming students depend on the payment behavior of previous and current IESE students.

FAQs

Yes, it is possible to cover the full cost through a mix of loans and scholarships.

All candidates, including international candidates, can apply for IESE scholarships and all admitted students can apply for loans.

We recommend you start planning your funding when you decide to do your MBA. This will ensure that you have ample time to design a comprehensive funding plan and take advantage of all financial aid opportunities.

The Financial Aid Office supports all students during the financial aid application process with lending institutions and scholarship organizations. You can contact the Financial Aid Office for help.

Contact the MBA Admissions team for more information about available scholarships.

Once you are admitted to the program, you can apply for one of the loans available at IESE. You will receive a letter with further instructions from the Financial Aid Office soon after being admitted.

Yes, international students have several private and public loan options. You can find more information here.

You should apply for loans as soon as you are admitted to the program and at least 2-3 months before your program starts. For the incoming students of the full-time MBA program, you will receive a letter from the Financial Aid Office including deadlines for submitting your financial plan.

Please contact the Financial Aid Office (faohelp@iese.edu) for more information about loan eligibility.

A bank guarantee is not usually required, but loans that require one (such as the Sabadell Bank loan) tend to have more attractive loan conditions.

The timing of scholarship decisions varies from program to program. You can contact the Admissions Department of the program for which you are applying for more specific information.

The bank evaluates student credit capacity on a case-by-case basis prior to granting a loan. Loan amounts and interest rates depend on the risk profile of each candidate: students’ loans, debt and savings, along with risks associated with their home country, such as exchange rate volatility.

Yes. IESE is registered with the U.S. Department of Education as an accredited foreign school and is eligible to disburse U.S. Federal Loans (Stafford Loan and Graduate PLUS Loan) through the Direct Loan Program for full-time MBA program students.

The fee for the full-time MBA program starting in September 2026 is €114,000.

Living expenses in Barcelona are comparably less than those of other large European cities.

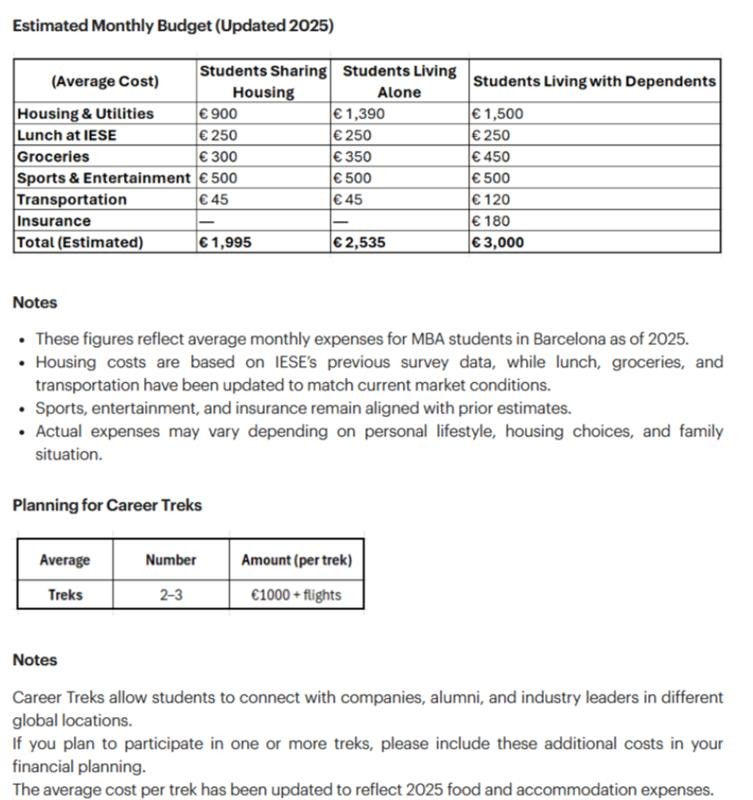

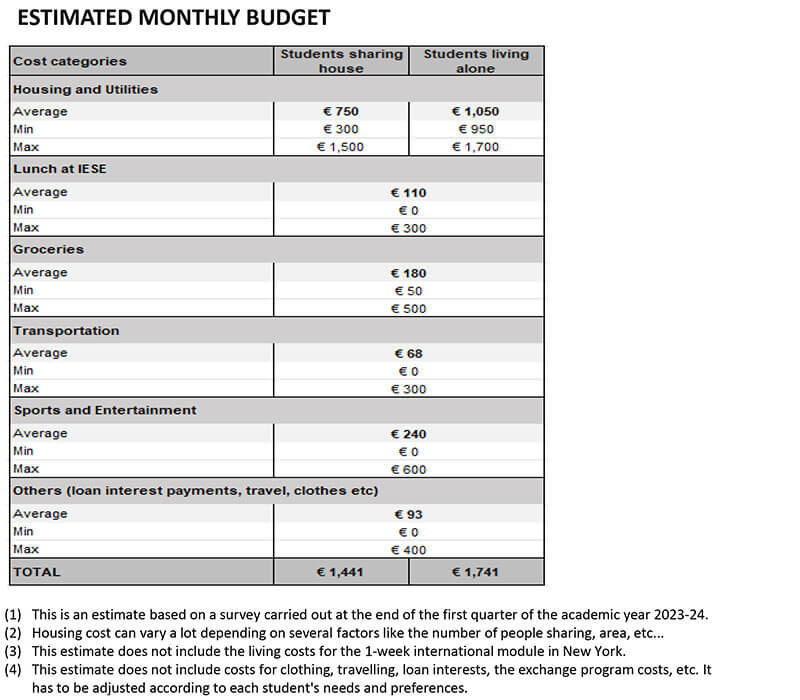

|

Living expenses in Madrid are comparably less than those of other large European cities.

|