IESE Insight

Challenges and strategic priorities of the food and beverage industry in Spain

The food and beverage sector prepares for a geopolitical shakeup that is redefining rules, supply chains and strategy.

Spain’s food and beverage industry is undergoing rapid transformation, shaped by geopolitical uncertainty, economic and regulatory challenges, and the urgent need to integrate sustainability and technology. A survey of 141 industry professionals attending the 28th edition of the Food & Beverage Meeting, organized by IESE Industry Meetings under the academic direction of Miquel Llado, sheds light on the most pressing strategic priorities and challenges for ensuring sustainable growth in this context.

The top priority for 32% of the companies surveyed is adapting to a changing environment marked by geopolitical, economic and regulatory volatility. This is followed by expansion through diversification and strategic alliances (25% of respondents). In third place, 15% identify attracting and retaining talent in increasingly decentralized and flexible environments as a key priority — an especially urgent challenge in the primary sector, where by 2030, 2 out of 3 farmers are expected to be over 65 years old. Finally, integrating innovation and artificial intelligence (AI) into processes and ensuring sustainability from the source, whether on land or at sea, each received 14% of mentions as strategic focus areas.

“These figures reflect an industry increasingly aware that the future of global trade is being shaped by growing geopolitical fragmentation, a redefinition of the rules of the game — such as friendshoring, regional blocs or new tariffs — and the accelerated transformation of supply chains,” says Llado.

Adding to this is the pressure to meet ambitious regulatory targets within tight deadlines. One of the immediate challenges is the implementation of a deposit-and-return system for plastic containers, cans and cartons before November 2026. This is a major challenge considering that, in 2023, Spain only recycled 41.3% of single-use plastic bottles — far short of the 70% required by regulation.

AI gains ground on the sector’s strategic agenda

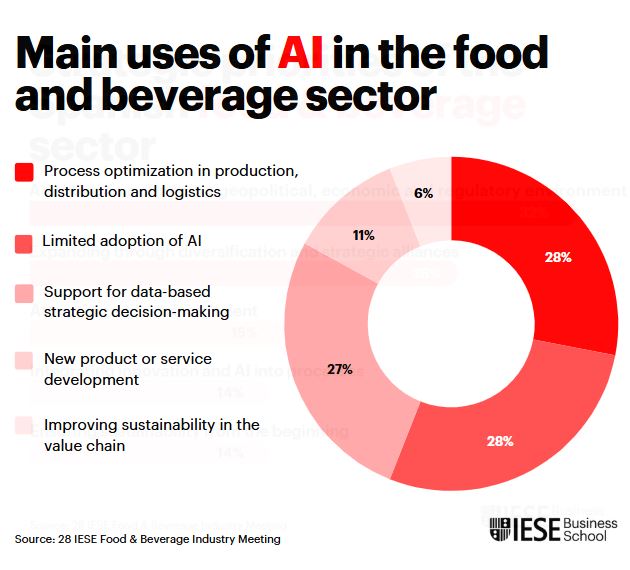

The survey also highlights the growing role of artificial intelligence (AI) in the sector’s transformation. Currently, 28% of companies are already using AI to optimize processes in production, distribution and logistics, while 27% employ it to support data-driven strategic decision-making. Other applications include the development of new products or services (11%) and enhancing sustainability across the value chain (6%). However, AI adoption remains limited for 28% of companies, revealing significant room for further integration.

In light of this scenario, what’s required, according to Llado, is a “constant transformation mindset” and the ability to “think big, without limits” in order to turn complexity into opportunity.

READ ALSO: